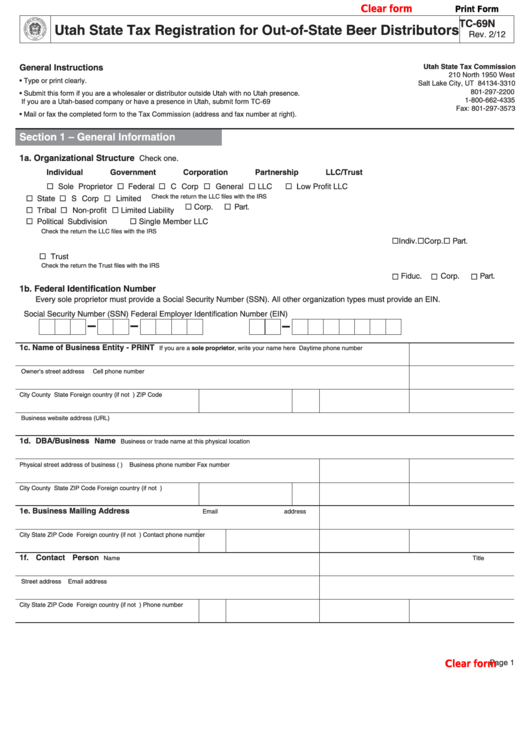

Clear form

Print Form

TC-69N

Utah State Tax Registration for Out-of-State Beer Distributors

Rev. 2/12

General Instructions

Utah State Tax Commission

210 North 1950 West

• Type or print clearly.

Salt Lake City, UT 84134-3310

801-297-2200

• Submit this form if you are a wholesaler or distributor outside Utah with no Utah presence.

1-800-662-4335

If you are a Utah-based company or have a presence in Utah, submit form TC-69

Fax: 801-297-3573

• Mail or fax the completed form to the Tax Commission (address and fax number at right).

tax.utah.gov

Section 1 – General Information

1a. Organizational Structure

Check one.

Individual

Government

Corporation

Partnership

LLC/Trust

Sole Proprietor

Federal

C Corp

General

LLC

Low Profit LLC

State

S Corp

Limited

Check the return the LLC files with the IRS

Corp.

Part.

Tribal

Non-profit

Limited Liability

Political Subdivision

Single Member LLC

Check the return the LLC files with the IRS

Indiv.

Corp.

Part.

Trust

Check the return the Trust files with the IRS

Fiduc.

Corp.

Part.

1b. Federal Identification Number

Every sole proprietor must provide a Social Security Number (SSN). All other organization types must provide an EIN.

Social Security Number (SSN)

Federal Employer Identification Number (EIN)

1c. Name of Business Entity - PRINT

If you are a sole proprietor, write your name here

Daytime phone number

Owner's street address

Cell phone number

City

County

State

Foreign country (if not U.S.)

ZIP Code

Business website address (URL)

1d. DBA/Business Name

Business or trade name at this physical location

Physical street address of business (P.O. Box not acceptable)

Business phone number

Fax number

City

County

State

ZIP Code

Foreign country (if not U.S.)

1e. Business Mailing Address

Email address

City

State

ZIP Code

Foreign country (if not U.S.)

Contact phone number

1f. Contact Person

Name

Title

Street address

Email address

City

State

ZIP Code

Foreign country (if not U.S.)

Phone number

Page 1

Clear form

1

1 2

2