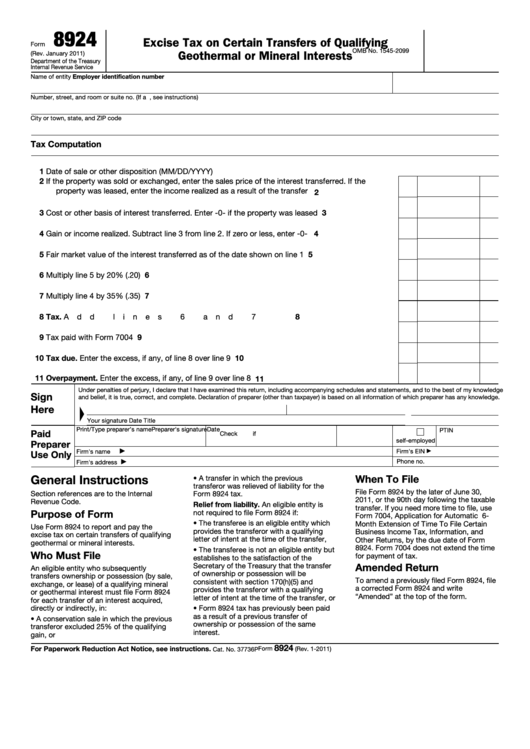

8924

Excise Tax on Certain Transfers of Qualifying

Form

OMB No. 1545-2099

Geothermal or Mineral Interests

(Rev. January 2011)

Department of the Treasury

Internal Revenue Service

Name of entity

Employer identification number

Number, street, and room or suite no. (If a P.O. box, see instructions)

City or town, state, and ZIP code

Tax Computation

1

Date of sale or other disposition (MM/DD/YYYY) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

If the property was sold or exchanged, enter the sales price of the interest transferred. If the

property was leased, enter the income realized as a result of the transfer .

.

.

.

.

.

.

.

2

3

Cost or other basis of interest transferred. Enter -0- if the property was leased .

.

.

.

.

.

3

4

Gain or income realized. Subtract line 3 from line 2. If zero or less, enter -0- .

.

.

.

.

.

.

4

5

5

Fair market value of the interest transferred as of the date shown on line 1

.

.

.

.

.

.

.

6

Multiply line 5 by 20% (.20) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Multiply line 4 by 35% (.35) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Tax. Add lines 6 and 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Tax paid with Form 7004 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

Tax due. Enter the excess, if any, of line 8 over line 9

10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Overpayment. Enter the excess, if any, of line 9 over line 8

.

.

.

.

.

.

.

.

.

.

.

.

11

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

Sign

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Your signature

Date

Title

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm's EIN

Firm's name

Use Only

▶

▶

Phone no.

Firm's address

▶

General Instructions

When To File

• A transfer in which the previous

transferor was relieved of liability for the

File Form 8924 by the later of June 30,

Section references are to the Internal

Form 8924 tax.

2011, or the 90th day following the taxable

Revenue Code.

Relief from liability. An eligible entity is

transfer. If you need more time to file, use

Purpose of Form

not required to file Form 8924 if:

Form 7004, Application for Automatic 6-

• The transferee is an eligible entity which

Month Extension of Time To File Certain

Use Form 8924 to report and pay the

provides the transferor with a qualifying

Business Income Tax, Information, and

excise tax on certain transfers of qualifying

letter of intent at the time of the transfer,

Other Returns, by the due date of Form

geothermal or mineral interests.

8924. Form 7004 does not extend the time

• The transferee is not an eligible entity but

Who Must File

for payment of tax.

establishes to the satisfaction of the

Amended Return

Secretary of the Treasury that the transfer

An eligible entity who subsequently

of ownership or possession will be

transfers ownership or possession (by sale,

To amend a previously filed Form 8924, file

consistent with section 170(h)(5) and

exchange, or lease) of a qualifying mineral

a corrected Form 8924 and write

provides the transferor with a qualifying

or geothermal interest must file Form 8924

“Amended” at the top of the form.

letter of intent at the time of the transfer, or

for each transfer of an interest acquired,

directly or indirectly, in:

• Form 8924 tax has previously been paid

as a result of a previous transfer of

• A conservation sale in which the previous

ownership or possession of the same

transferor excluded 25% of the qualifying

interest.

gain, or

8924

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 1-2011)

Cat. No. 37736P

1

1 2

2