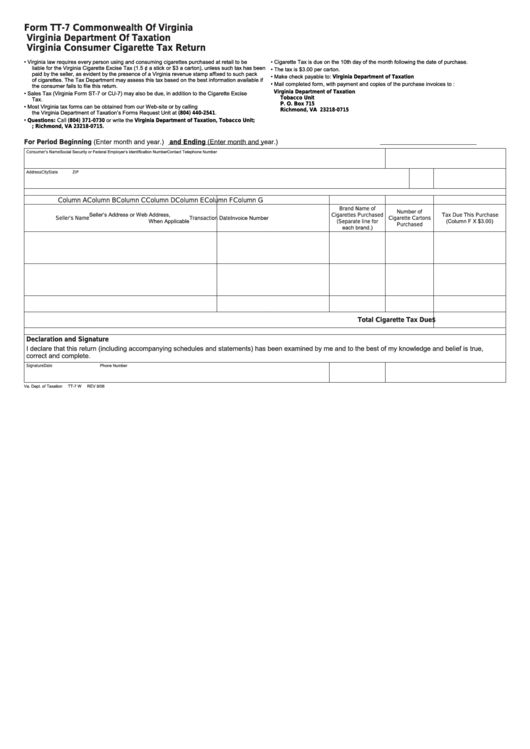

Form TT-7

Commonwealth Of Virginia

Virginia Department Of Taxation

Virginia Consumer Cigarette Tax Return

•

Virginia law requires every person using and consuming cigarettes purchased at retail to be

•

Cigarette Tax is due on the 10th day of the month following the date of purchase.

liable for the Virginia Cigarette Excise Tax (1.5 ¢ a stick or $3 a carton), unless such tax has been

•

The tax is $3.00 per carton.

paid by the seller, as evident by the presence of a Virginia revenue stamp affixed to such pack

•

Make check payable to: Virginia Department of Taxation

of cigarettes. The Tax Department may assess this tax based on the best information available if

Mail completed form, with payment and copies of the purchase invoices to :

the consumer fails to file this return.

•

•

Sales Tax (Virginia Form ST-7 or CU-7) may also be due, in addition to the Cigarette Excise

Virginia Department of Taxation

Tobacco Unit

Tax.

P. O. Box 715

•

Most Virginia tax forms can be obtained from our Web-site or by calling

Richmond, VA 23218-0715

the Virginia Department of Taxation’s Forms Request Unit at (804) 440-2541.

Questions: Call (804) 371-0730 or write the Virginia Department of Taxation, Tobacco Unit;

•

P.O. Box 715; Richmond, VA 23218-0715.

For Period Beginning (Enter month and year.)

and Ending (Enter month and year.)

Social Security or Federal Employer’s identification Number

Contact Telephone Number

Consumer’s Name

Address

City

State

ZIP

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Brand Name of

Number of

Seller’s Address or Web Address,

Cigarettes Purchased

Tax Due This Purchase

Invoice Number

Seller’s Name

Transaction Date

Cigarette Cartons

When Applicable

(Column F X $3.00)

(Separate line for

Purchased

each brand.)

Total Cigarette Tax Due $

Declaration and Signature

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true,

correct and complete.

Phone Number

Signature

Date

Va. Dept. of Taxation

TT-7 W

REV 9/06

1

1