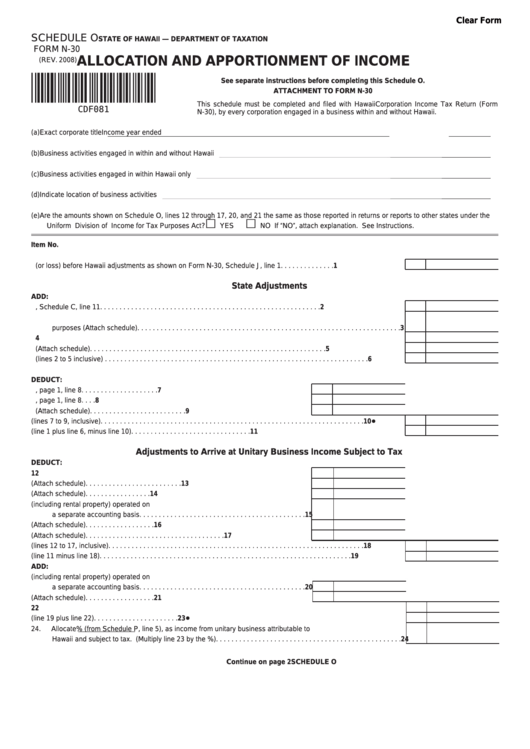

Clear Form

SCHEDULE O

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM N-30

ALLOCATION AND APPORTIONMENT OF INCOME

(REV. 2008)

See separate instructions before completing this Schedule O.

ATTACHMENT TO FORM N-30

This schedule must be completed and filed with Hawaii Corporation Income Tax Return (Form

CDF081

N-30), by every corporation engaged in a business within and without Hawaii.

(a) Exact corporate title

Income year ended

(b) Business activities engaged in within and without Hawaii

(c)

Business activities engaged in within Hawaii only

(d) Indicate location of business activities

(e) Are the amounts shown on Schedule O, lines 12 through 17, 20, and 21 the same as those reported in returns or reports to other states under the

£

£

Uniform Division of Income for Tax Purposes Act?

YES

NO If “NO”, attach explanation. See Instructions.

Item No.

1.

Taxable income (or loss) before Hawaii adjustments as shown on Form N-30, Schedule J, line 1. . . . . . . . . . . . . .

1

State Adjustments

ADD:

2.

Dividends from N-30, Schedule C, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3.

Deductions allowable for federal tax purposes but not allowable or allowable only in part for Hawaii tax

purposes (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4.

Deduction for charitable contributions included in line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5.

Other adjustments (Attach schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6.

Total (lines 2 to 5 inclusive) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

DEDUCT:

7.

Dividends received included on Form N-30, page 1, line 8 . . . . . . . . . . . . . . . . . . . .

7

8.

Interest on obligations of United States included on Form N-30, page 1, line 8 . . . .

8

9.

Other deductions or adjustments (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . .

9

10.

Total (lines 7 to 9, inclusive). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10!

11.

Taxable income after Hawaii adjustments (line 1 plus line 6, minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

Adjustments to Arrive at Unitary Business Income Subject to Tax

DEDUCT:

12.

Non-business or nonunitary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13.

Interest from nonunitary business (Attach schedule). . . . . . . . . . . . . . . . . . . . . . . . .

13

14.

Royalties from nonunitary business assets (Attach schedule) . . . . . . . . . . . . . . . . .

14

15.

Net profit from nonunitary business (including rental property) operated on

a separate accounting basis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16.

Net gain from nonunitary business assets (Attach schedule) . . . . . . . . . . . . . . . . . .

16

17.

Other adjustments (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18.

Total (lines 12 to 17, inclusive). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19.

Balance (line 11 minus line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

ADD:

20.

Net loss from nonunitary business (including rental property) operated on

a separate accounting basis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21.

Net loss from nonunitary business assets (Attach schedule) . . . . . . . . . . . . . . . . . .

21

22.

Total of lines 20 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23.

Unitary business income from sources within and without Hawaii (line 19 plus line 22) . . . . . . . . . . . . . . . . . . . . . .

23!

24.

Allocate

% (from Schedule P, line 5), as income from unitary business attributable to

Hawaii and subject to tax. (Multiply line 23 by the %) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

Continue on page 2

SCHEDULE O

1

1 2

2