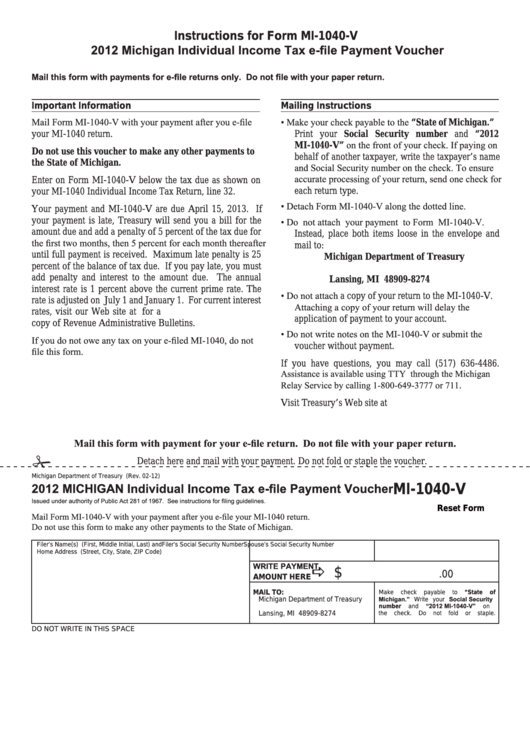

Instructions for Form MI-1040-V

2012 Michigan Individual Income Tax e-file Payment Voucher

Mail this form with payments for e-file returns only. Do not file with your paper return.

Important Information

Mailing Instructions

Mail Form MI-1040-V with your payment after you e-file

•

Make your check payable to the “State of Michigan.”

your MI-1040 return.

Print your Social Security number and “2012

MI-1040-V” on the front of your check. If paying on

Do not use this voucher to make any other payments to

behalf of another taxpayer, write the taxpayer’s name

the State of Michigan.

and Social Security number on the check. To ensure

accurate processing of your return, send one check for

Enter on Form MI-1040-V below the tax due as shown on

each return type.

your MI-1040 Individual Income Tax Return, line 32.

•

Detach Form MI-1040-V along the dotted line.

Your payment and MI-1040-V are due April 15, 2013. If

•

Do not attach your payment to Form MI-1040-V.

your payment is late, Treasury will send you a bill for the

amount due and add a penalty of 5 percent of the tax due for

Instead, place both items loose in the envelope and

the first two months, then 5 percent for each month thereafter

mail to:

until full payment is received. Maximum late penalty is 25

Michigan Department of Treasury

percent of the balance of tax due. If you pay late, you must

P.O. Box 30774

add penalty and interest to the amount due. The annual

Lansing, MI 48909-8274

interest rate is 1 percent above the current prime rate. The

•

Do not attach a copy of your return to the MI-1040-V.

rate is adjusted on July 1 and January 1. For current interest

Attaching a copy of your return will delay the

rates, visit our Web site at for a

application of payment to your account.

copy of Revenue Administrative Bulletins.

•

Do not write notes on the MI-1040-V or submit the

If you do not owe any tax on your e-filed MI-1040, do not

voucher without payment.

file this form.

If you have questions, you may call (517) 636-4486.

Assistance is available using TTY through the Michigan

Relay Service by calling 1-800-649-3777 or 711 .

Visit Treasury’s Web site at

Mail this form with payment for your e-file return. Do not file with your paper return.

#

Detach here and mail with your payment. Do not fold or staple the voucher.

Michigan Department of Treasury (Rev. 02-12)

2012 MICHIGAN Individual Income Tax e-file Payment Voucher

MI-1040-V

Issued under authority of Public Act 281 of 1967. See instructions for filing guidelines.

Reset Form

Mail Form MI-1040-V with your payment after you e-file your MI-1040 return.

Do not use this form to make any other payments to the State of Michigan.

Filer’s Name(s) (First, Middle Initial, Last) and

Filer’s Social Security Number

Spouse’s Social Security Number

Home Address (Street, City, State, ZIP Code)

WRITE PAYMENT

a $

.00

AMOUNT HERE

MAIL TO:

Make

check

payable

to

“State

of

Michigan.” Write your Social Security

Michigan Department of Treasury

“2012

MI-1040-V”

P.O. Box 30774

number

and

on

Lansing, MI 48909-8274

the

check.

Do

not

fold

or

staple.

DO NOT WRITE IN THIS SPACE

1

1