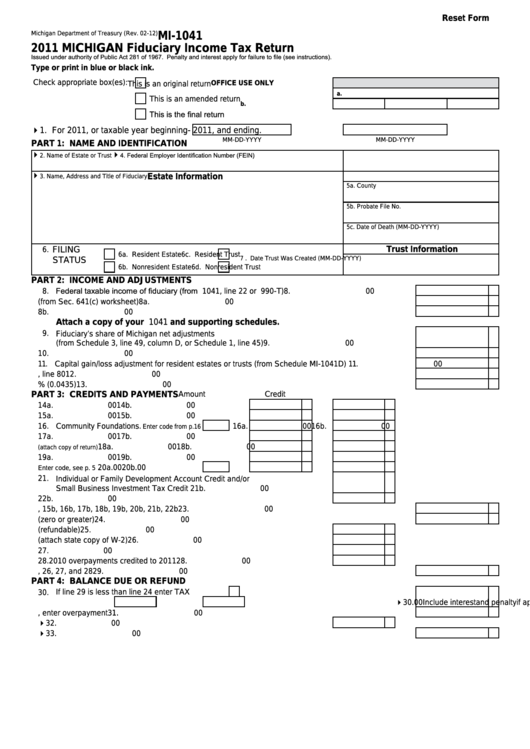

Reset Form

Michigan Department of Treasury (Rev. 02-12)

MI-1041

2011 MICHIGAN Fiduciary Income Tax Return

Issued under authority of Public Act 281 of 1967. Penalty and interest apply for failure to file (see instructions).

Type or print in blue or black ink.

Check appropriate box(es):

OFFICE USE ONLY

This is an original return

a.

This is an amended return

b.

This is the final return

41. For 2011, or taxable year beginning

- 2011

, and ending

.

MM-DD-YYYY

MM-DD-YYYY

PART 1: NAME AND IDENTIFICATION

4

4

4. Federal Employer Identification Number (FEIN)

2. Name of Estate or Trust

4

Estate Information

3. Name, Address and Title of Fiduciary

5a. County

5b. Probate File No.

5c. Date of Death (MM-DD-YYYY)

Trust Information

FILING

6.

6a. Resident Estate

6c. Resident Trust

7 . Date Trust Was Created (MM-DD-YYYY)

STATUS

6b. Nonresident Estate

6d. Nonresident Trust

PART 2: INCOME AND ADJUSTMENTS

8. Federal taxable income of fiduciary (from U.S. Form 1041, line 22 or U.S. Form 990-T) ..................

8.

00

8a. Federal taxable income of ESBT (from Sec. 641(c) worksheet) ........................................................

8a.

00

8b. Total. Add lines 8 and 8a ....................................................................................................................

8b.

00

Attach a copy of your U.S. Form 1041 and supporting schedules.

9. Fiduciary’s share of Michigan net adjustments

(from Schedule 3, line 49, column D, or Schedule 1, line 45) ............................................................

9.

00

10. Total. Combine lines 8b and 9 ............................................................................................................

10.

00

11. Capital gain/loss adjustment for resident estates or trusts (from Schedule MI-1041D)......................

11.

00

12. Taxable income. Combine lines 10 and 11 or enter amount from Schedule 4, line 80 .......................

12.

00

13. Tax. Multiply line 12 by 4.35% (0.0435) ..............................................................................................

13.

00

PART 3: CREDITS AND PAYMENTS

Amount

Credit

14. City Income Tax Credit ........................................... 14a.

00 14b.

00

15. Public Contribution Credit ....................................... 15a.

00 15b.

00

16. Community Foundations.

16a.

00 16b.

00

Enter code from p.16

17. Homeless Shelter/Food Bank Credit ...................... 17a.

00 17b.

00

18. Income tax paid to another state

18a.

00 18b.

00

(attach copy of return)

19. Michigan Historic Preservation Tax Credit .............. 19a.

00 19b.

00

20. Vehicle Donation Credit.

20a.

00 20b.

00

Enter code, see p. 5

21. Individual or Family Development Account Credit and/or

Small Business Investment Tax Credit ........................................................ 21b.

00

22. Renewable Energy Surcharge Credit ........................................................... 22b.

00

23. Total nonrefundable credits. Add 14b, 15b, 16b, 17b, 18b, 19b, 20b, 21b, 22b ................................

23.

00

24. Income tax. Subtract line 23 from line 13 (zero or greater) ................................................................

24.

00

25. Michigan Historic Preservation Tax Credit (refundable) ...............................

25.

00

26. Income tax withheld (attach state copy of W-2) ............................................

26.

00

27. Michigan estimated tax and extension payments .........................................

27.

00

28. 2010 overpayments credited to 2011 ...........................................................

28.

00

29. Add lines 25, 26, 27, and 28 ...............................................................................................................

29.

00

PART 4: BALANCE DUE OR REFUND

30. If line 29 is less than line 24 enter TAX DUE.

a.

Check if MI-2210 is attached.

430.

Include interest

and penalty

if applicable (see inst., p. 5) .......................

00

31. If line 29 is greater than line 24, enter overpayment ..........................................................................

31.

00

32. Amount of line 31 to be credited to your 2012 ESTIMATED TAX ................. 432.

00

33. Subtract line 32 from line 31. This is your REFUND .......................................................................... 433.

00

1

1 2

2 3

3 4

4