Print Form

Reset Form

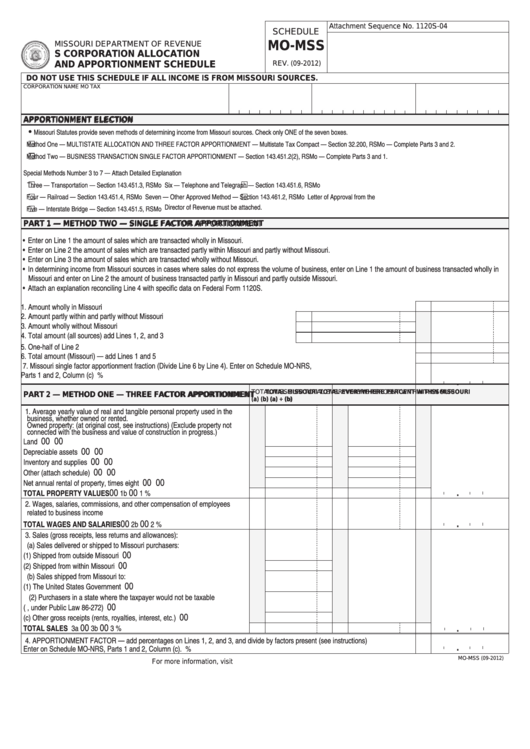

Attachment Sequence No. 1120S-04

SCHEDULE

MO-MSS

MISSOURI DEPARTMENT OF REVENUE

S CORPORATION ALLOCATION

AND APPORTIONMENT SCHEDULE

REV. (09-2012)

DO NOT USE THIS SCHEDULE IF ALL INCOME IS FROM MISSOURI SOURCES.

CORPORATION NAME

MO TAX I.D. NUMBER

CHARTER NUMBER

FEDERAL I.D. NUMBER

APPORTIONMENT ELECTION

APPORTIONMENT ELECTION

•

Missouri Statutes provide seven methods of determining income from Missouri sources. Check only ONE of the seven boxes.

Method One — MULTISTATE ALLOCATION AND THREE FACTOR APPORTIONMENT — Multistate Tax Compact — Section 32.200, RSMo — Complete Parts 3 and 2.

Method Two — BUSINESS TRANSACTION SINGLE FACTOR APPORTIONMENT — Section 143.451.2(2), RSMo — Complete Parts 3 and 1.

Special Methods Number 3 to 7 — Attach Detailed Explanation

Three — Transportation — Section 143.451.3, RSMo

Six — Telephone and Telegraph — Section 143.451.6, RSMo

Four — Railroad — Section 143.451.4, RSMo

Seven — Other Approved Method — Section 143.461.2, RSMo Letter of Approval from the

Director of Revenue must be attached.

Five — Interstate Bridge — Section 143.451.5, RSMo

PART 1 — METHOD TWO — SINGLE FACTOR APPORTIONMENT

PART 1 — METHOD TWO — SINGLE FACTOR APPORTIONMENT

• Enter on Line 1 the amount of sales which are transacted wholly in Missouri.

• Enter on Line 2 the amount of sales which are transacted partly within Missouri and partly without Missouri.

• Enter on Line 3 the amount of sales which are transacted wholly without Missouri.

• In determining income from Missouri sources in cases where sales do not express the volume of business, enter on Line 1 the amount of business transacted wholly in

Missouri and enter on Line 2 the amount of business transacted partly in Missouri and partly outside Missouri.

• Attach an explanation reconciling Line 4 with specific data on Federal Form 1120S.

1. Amount wholly in Missouri ..........................................................................................................................................................................

1

00

2. Amount partly within and partly without Missouri .................................................................... 2

00

3. Amount wholly without Missouri .............................................................................................. 3

00

4. Total amount (all sources) add Lines 1, 2, and 3 .................................................................... 4

00

5. One‑half of Line 2 .....................................................................................................................................................................................

5

00

6. Total amount (Missouri) — add Lines 1 and 5 .........................................................................................................................................

6

00

7. Missouri single factor apportionment fraction (Divide Line 6 by Line 4). Enter on Schedule MO‑NRS,

Parts 1 and 2, Column (c) ........................................................................................................................................................................

7

%

.

.

TOTAL MISSOURI

TOTAL MISSOURI

TOTAL EVERYWHERE

TOTAL EVERYWHERE

PERCENT WITHIN MISSOURI

PERCENT WITHIN MISSOURI

PART 2 — METHOD ONE — THREE FACTOR APPORTIONMENT

PART 2 — METHOD ONE — THREE FACTOR APPORTIONMENT

(a)

(a)

(b)

(b)

(a) ÷ (b)

(a) ÷ (b)

1. Average yearly value of real and tangible personal property used in the

business, whether owned or rented.

Owned property: (at original cost, see instructions) (Exclude property not

connected with the business and value of construction in progress.)

00

00

Land ............................................................................................................

00

00

Depreciable assets ......................................................................................

00

00

Inventory and supplies ................................................................................

00

00

Other (attach schedule) ...............................................................................

00

00

Net annual rental of property, times eight ...................................................

.

00

00

TOTAL PROPERTY VALUES ...........................................................................

1a

1b

1

%

2. Wages, salaries, commissions, and other compensation of employees

related to business income

00

00

.

TOTAL WAGES AND SALARIES .....................................................................

2a

2b

2

%

3. Sales (gross receipts, less returns and allowances):

(a) Sales delivered or shipped to Missouri purchasers:

00

(1) Shipped from outside Missouri ..........................................................

00

(2) Shipped from within Missouri ............................................................

(b) Sales shipped from Missouri to:

00

(1) The United States Government .........................................................

(2) Purchasers in a state where the taxpayer would not be taxable

00

(e.g., under Public Law 86‑272) ........................................................

00

(c) Other gross receipts (rents, royalties, interest, etc.) ..............................

00

00

.

TOTAL SALES

3a

3b

3

%

4. APPORTIONMENT FACTOR — add percentages on Lines 1, 2, and 3, and divide by factors present (see instructions)

.

Enter on Schedule MO‑NRS, Parts 1 and 2, Column (c). ........................................................................................................................

4

%

MO-MSS (09-2012)

For more information, visit

1

1 2

2