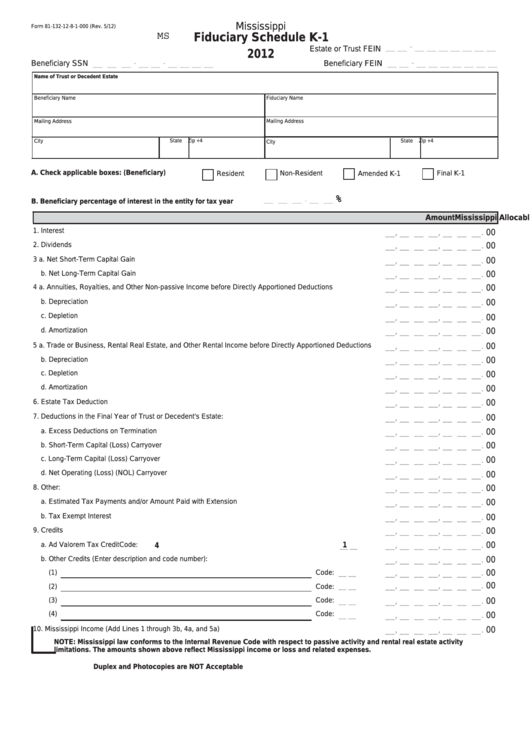

Mississippi

Form 81-132-12-8-1-000 (Rev. 5/12)

Fiduciary Schedule K-1

__ __ - __ __ __ __ __ __ __

Estate or Trust FEIN

2012

__ __ __ - __ __ - __ __ __ __

__ __ - __ __ __ __ __ __ __

Beneficiary SSN

Beneficiary FEIN

Name of Trust or Decedent Estate

Beneficiary Name

Fiduciary Name

Mailing Address

Mailing Address

Zip +4

State

Zip +4

City

State

City

A. Check applicable boxes: (Beneficiary)

Non-Resident

Final K-1

Resident

Amended K-1

%

__ __ __ . __ __

B. Beneficiary percentage of interest in the entity for tax year

Mississippi Allocable Share Item

Amount

1. Interest

__, __ __ __, __ __ __.

00

2. Dividends

__, __ __ __, __ __ __.

00

3 a. Net Short-Term Capital Gain

__, __ __ __, __ __ __.

00

b. Net Long-Term Capital Gain

__, __ __ __, __ __ __.

00

4 a. Annuities, Royalties, and Other Non-passive Income before Directly Apportioned Deductions

__, __ __ __, __ __ __.

00

b. Depreciation

__, __ __ __, __ __ __.

00

c. Depletion

__, __ __ __, __ __ __.

00

d. Amortization

__, __ __ __, __ __ __.

00

5 a. Trade or Business, Rental Real Estate, and Other Rental Income before Directly Apportioned Deductions

__, __ __ __, __ __ __.

00

b. Depreciation

__, __ __ __, __ __ __.

00

c. Depletion

__, __ __ __, __ __ __.

00

d. Amortization

__, __ __ __, __ __ __.

00

6. Estate Tax Deduction

__, __ __ __, __ __ __.

00

7. Deductions in the Final Year of Trust or Decedent's Estate:

__, __ __ __, __ __ __.

00

a. Excess Deductions on Termination

__, __ __ __, __ __ __.

00

b. Short-Term Capital (Loss) Carryover

__, __ __ __, __ __ __.

00

c. Long-Term Capital (Loss) Carryover

__, __ __ __, __ __ __.

00

d. Net Operating (Loss) (NOL) Carryover

__, __ __ __, __ __ __.

00

8. Other:

__, __ __ __, __ __ __.

00

a. Estimated Tax Payments and/or Amount Paid with Extension

__, __ __ __, __ __ __.

00

b. Tax Exempt Interest

__, __ __ __, __ __ __.

00

9. Credits

__, __ __ __, __ __ __.

00

a. Ad Valorem Tax Credit

Code:

1

__, __ __ __, __ __ __.

00

4

__ __

b. Other Credits (Enter description and code number):

__, __ __ __, __ __ __.

00

(1)

Code:

__, __ __ __, __ __ __.

00

__ __

__, __ __ __, __ __ __.

00

__ __

(2)

Code:

(3)

Code:

__, __ __ __, __ __ __.

00

__ __

(4)

Code:

__, __ __ __, __ __ __.

00

__ __

10. Mississippi Income (Add Lines 1 through 3b, 4a, and 5a)

__, __ __ __, __ __ __.

00

NOTE: Mississippi law conforms to the Internal Revenue Code with respect to passive activity and rental real estate activity

limitations. The amounts shown above reflect Mississippi income or loss and related expenses.

Duplex and Photocopies are NOT Acceptable

1

1