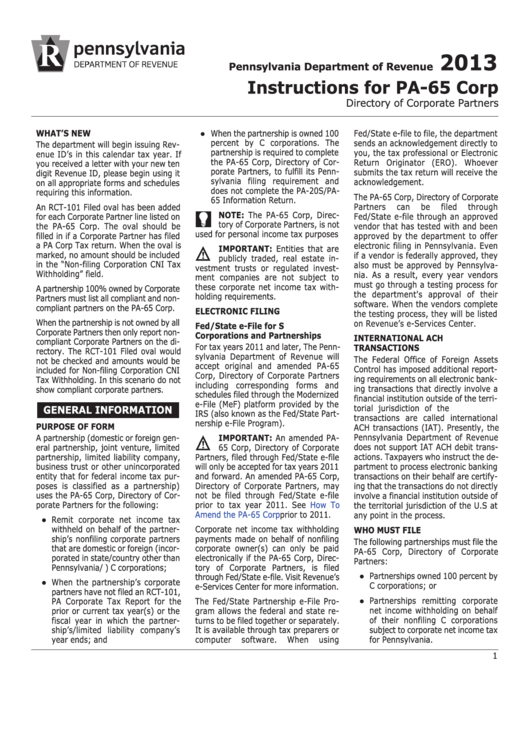

Instructions For Form Pa-65 Corp - Directory Of Corporate Partners - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-65 Corp

Directory of Corporate Partners

WHAT’S NEW

● When the partnership is owned 100

Fed/State e-file to file, the department

percent by C corporations. The

sends an acknowledgement directly to

The department will begin issuing Rev-

partnership is required to complete

you, the tax professional or Electronic

enue ID’s in this calendar tax year. If

the PA-65 Corp, Directory of Cor-

Return Originator (ERO). Whoever

you received a letter with your new ten

porate Partners, to fulfill its Penn-

submits the tax return will receive the

digit Revenue ID, please begin using it

sylvania filing requirement and

acknowledgement.

on all appropriate forms and schedules

does not complete the PA-20S/PA-

requiring this information.

The PA-65 Corp, Directory of Corporate

65 Information Return.

Partners

can

be

filed

through

An RCT-101 Filed oval has been added

NOTE: The PA-65 Corp, Direc-

Fed/State e-file through an approved

for each Corporate Partner line listed on

tory of Corporate Partners, is not

vendor that has tested with and been

the PA-65 Corp. The oval should be

used for personal income tax purposes

filled in if a Corporate Partner has filed

approved by the department to offer

a PA Corp Tax return. When the oval is

electronic filing in Pennsylvania. Even

IMPORTANT: Entities that are

marked, no amount should be included

if a vendor is federally approved, they

publicly traded, real estate in-

in the “Non-filing Corporation CNI Tax

also must be approved by Pennsylva-

vestment trusts or regulated invest-

Withholding” field.

nia. As a result, every year vendors

ment companies are not subject to

must go through a testing process for

these corporate net income tax with-

A partnership 100% owned by Corporate

the department's approval of their

holding requirements.

Partners must list all compliant and non-

software. When the vendors complete

compliant partners on the PA-65 Corp.

ELECTRONIC FILING

the testing process, they will be listed

When the partnership is not owned by all

on Revenue’s e-Services Center.

Fed/State e-File for S

Corporate Partners then only report non-

Corporations and Partnerships

INTERNATIONAL ACH

compliant Corporate Partners on the di-

For tax years 2011 and later, The Penn-

TRANSACTIONS

rectory. The RCT-101 Filed oval would

sylvania Department of Revenue will

The Federal Office of Foreign Assets

not be checked and amounts would be

accept original and amended PA-65

Control has imposed additional report-

included for Non-filing Corporation CNI

Corp, Directory of Corporate Partners

ing requirements on all electronic bank-

Tax Withholding. In this scenario do not

including corresponding forms and

ing transactions that directly involve a

show compliant corporate partners.

schedules filed through the Modernized

financial institution outside of the terri-

e-File (MeF) platform provided by the

torial jurisdiction of the U.S. These

GENERAL INFORMATION

IRS (also known as the Fed/State Part-

transactions are called international

nership e-File Program).

PURPOSE OF FORM

ACH transactions (IAT). Presently, the

Pennsylvania Department of Revenue

A partnership (domestic or foreign gen-

IMPORTANT: An amended PA-

eral partnership, joint venture, limited

does not support IAT ACH debit trans-

65 Corp, Directory of Corporate

partnership, limited liability company,

Partners, filed through Fed/State e-file

actions. Taxpayers who instruct the de-

business trust or other unincorporated

will only be accepted for tax years 2011

partment to process electronic banking

entity that for federal income tax pur-

and forward. An amended PA-65 Corp,

transactions on their behalf are certify-

poses is classified as a partnership)

Directory of Corporate Partners, may

ing that the transactions do not directly

uses the PA-65 Corp, Directory of Cor-

not be filed through Fed/State e-file

involve a financial institution outside of

porate Partners for the following:

prior to tax year 2011. See

How To

the territorial jurisdiction of the U.S at

Amend the PA-65 Corp

prior to 2011.

any point in the process.

● Remit corporate net income tax

withheld on behalf of the partner-

Corporate net income tax withholding

WHO MUST FILE

ship’s nonfiling corporate partners

payments made on behalf of nonfiling

The following partnerships must file the

that are domestic or foreign (incor-

corporate owner(s) can only be paid

PA-65 Corp, Directory of Corporate

porated in state/country other than

electronically if the PA-65 Corp, Direc-

Partners:

Pennsylvania/U.S.) C corporations;

tory of Corporate Partners, is filed

● Partnerships owned 100 percent by

through Fed/State e-file. Visit Revenue’s

● When the partnership’s corporate

C corporations; or

e-Services Center for more information.

partners have not filed an RCT-101,

● Partnerships remitting corporate

PA Corporate Tax Report for the

The Fed/State Partnership e-File Pro-

net income withholding on behalf

prior or current tax year(s) or the

gram allows the federal and state re-

of their nonfiling C corporations

fiscal year in which the partner-

turns to be filed together or separately.

subject to corporate net income tax

ship’s/limited liability company’s

It is available through tax preparers or

year ends; and

computer

software.

When

using

for Pennsylvania.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8