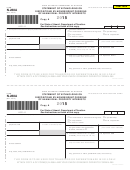

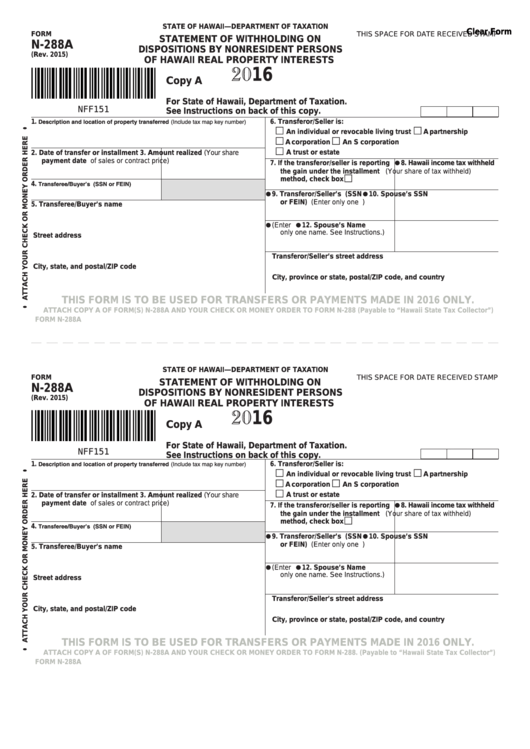

STATE OF HAWAII—DEPARTMENT OF TAXATION

Clear Form

FORM

THIS SPACE FOR DATE RECEIVED STAMP

STATEMENT OF WITHHOLDING ON

N-288A

DISPOSITIONS BY NONRESIDENT PERSONS

(Rev. 2015)

OF HAWAII REAL PROPERTY INTERESTS

2016

Copy A

For State of Hawaii, Department of Taxation.

NFF151

See Instructions on back of this copy.

1. Description and location of property transferred (Include tax map key number)

6. Transferor/Seller is:

An individual or revocable living trust

A partnership

A corporation

An S corporation

2. Date of transfer or installment

3. Amount realized (Your share

A trust or estate

payment date

of sales or contract price)

7. If the transferor/seller is reporting

8. Hawaii income tax withheld

the gain under the installment

(Your share of tax withheld)

method, check box

4. Transferee/Buyer’s I.D. no. (SSN or FEIN)

9. Transferor/Seller’s I.D. no. (SSN

10. Spouse’s SSN

or FEIN) (Enter only one I.D. no.)

5. Transferee/Buyer’s name

11.Name of transferor/seller (Enter

12. Spouse’s Name

only one name. See Instructions.)

Street address

Transferor/Seller’s street address

City, state, and postal/ZIP code

City, province or state, postal/ZIP code, and country

THIS FORM IS TO BE USED FOR TRANSFERS OR PAYMENTS MADE IN 2016 ONLY.

ATTACH COPY A OF FORM(S) N-288A AND YOUR CHECK OR MONEY ORDER TO FORM N-288 (Payable to “Hawaii State Tax Collector”)

FORM N-288A

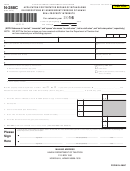

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM

THIS SPACE FOR DATE RECEIVED STAMP

STATEMENT OF WITHHOLDING ON

N-288A

DISPOSITIONS BY NONRESIDENT PERSONS

(Rev. 2015)

OF HAWAII REAL PROPERTY INTERESTS

2016

Copy A

For State of Hawaii, Department of Taxation.

NFF151

See Instructions on back of this copy.

1. Description and location of property transferred (Include tax map key number)

6. Transferor/Seller is:

An individual or revocable living trust

A partnership

A corporation

An S corporation

2. Date of transfer or installment

3. Amount realized (Your share

A trust or estate

payment date

of sales or contract price)

7. If the transferor/seller is reporting

8. Hawaii income tax withheld

the gain under the installment

(Your share of tax withheld)

method, check box

4. Transferee/Buyer’s I.D. no. (SSN or FEIN)

9. Transferor/Seller’s I.D. no. (SSN

10. Spouse’s SSN

or FEIN) (Enter only one I.D. no.)

5. Transferee/Buyer’s name

11.Name of transferor/seller (Enter

12. Spouse’s Name

only one name. See Instructions.)

Street address

Transferor/Seller’s street address

City, state, and postal/ZIP code

City, province or state, postal/ZIP code, and country

THIS FORM IS TO BE USED FOR TRANSFERS OR PAYMENTS MADE IN 2016 ONLY.

ATTACH COPY A OF FORM(S) N-288A AND YOUR CHECK OR MONEY ORDER TO FORM N-288. (Payable to “Hawaii State Tax Collector”)

FORM N-288A

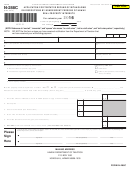

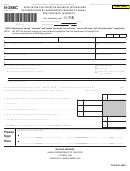

1

1 2

2 3

3 4

4 5

5