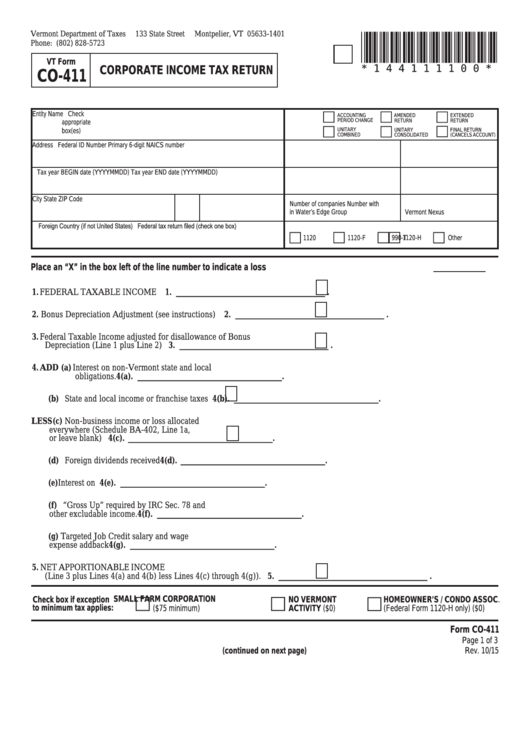

Vt Form Co-411 - Corporate Income Tax Return

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*144111100*

Phone: (802) 828-5723

VT Form

CORPORATE INCOME TAX RETURN

CO-411

* 1 4 4 1 1 1 1 0 0 *

Entity Name

Check

ACCOUNTING

AMENDED

EXTENDED

PERIOD CHANGE

appropriate

RETURN

RETURN

box(es)

UNITARY

UNITARY

FINAL RETURN

COMBINED

CONSOLIDATED

(CANCELS ACCOUNT)

Address

Federal ID Number

Primary 6-digit NAICS number

Tax year BEGIN date (YYYYMMDD)

Tax year END date (YYYYMMDD)

City

State

ZIP Code

Number of companies

Number with

in Water’s Edge Group

Vermont Nexus

Foreign Country (if not United States)

Federal tax return filed (check one box)

1120

1120-F

990-T

1120-H

Other

Place an “X” in the box left of the line number to indicate a loss amount.

Enter all amounts in whole dollars.

1. FEDERAL TAXABLE INCOME . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1. __________________________________ .

2. Bonus Depreciation Adjustment (see instructions) . . . . . . . . . . . . . . . . . . . . .

2. __________________________________ .

3. Federal Taxable Income adjusted for disallowance of Bonus

Depreciation (Line 1 plus Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. __________________________________ .

4. ADD (a) Interest on non-Vermont state and local

obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4(a). _________________________________ .

(b) State and local income or franchise taxes

4(b). _________________________________ .

LESS (c) Non-business income or loss allocated

everywhere (Schedule BA-402, Line 1a,

or leave blank) . . . . . . . . . . . . . . . . . . . .

4(c). _________________________________ .

(d) Foreign dividends received . . . . . . . . . . . . . . 4(d). _________________________________ .

(e) Interest on U .S . Government obligations . . . . .4(e). _________________________________ .

(f) “Gross Up” required by IRC Sec . 78 and

other excludable income . . . . . . . . . . . . . . . . . . 4(f). _________________________________ .

(g) Targeted Job Credit salary and wage

expense addback . . . . . . . . . . . . . . . . . . . . . . 4(g). _________________________________ .

5. NET APPORTIONABLE INCOME

(Line 3 plus Lines 4(a) and 4(b) less Lines 4(c) through 4(g)) . . . . . . . . . . . . .

5. __________________________________ .

SMALL FARM CORPORATION

NO VERMONT

Check box if exception

HOMEOWNER’S / CONDO ASSOC.

to minimum tax applies:

($75 minimum)

ACTIVITY ($0)

(Federal Form 1120-H only) ($0)

Form CO-411

Page 1 of 3

(continued on next page)

Rev. 10/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3