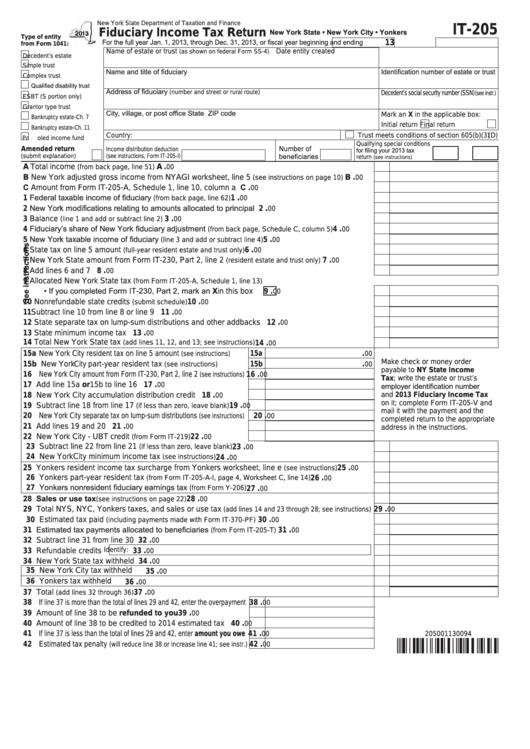

New York State Department of Taxation and Finance

IT-205

Fiduciary Income Tax Return

New York State • New York City • Yonkers

Type of entity

For the full year Jan. 1, 2013, through Dec. 31, 2013, or fiscal year beginning

and ending

13

from Form 1041:

Name of estate or trust

Date entity created

(as shown on federal Form SS-4)

Decedent’s estate

Simple trust

Name and title of fiduciary

Identification number of estate or trust

Complex trust

Qualified disability trust

Address of fiduciary

Decedent’s social security number (SSN)

(number and street or rural route)

(see instr.)

ESBT (S portion only)

Grantor type trust

City, village, or post office

State

ZIP code

Mark an X in the applicable box:

Bankruptcy estate-Ch. 7

Initial return

Final return

Bankruptcy estate-Ch. 11

Country:

Trust meets conditions of section 605(b)(3)(D)

Pooled income fund

Qualifying special conditions

Amended return

Number of

for filing your 2013 tax

Income distribution deduction

beneficiaries

(submit explanation)

(see instructions, Form IT-205-I)

return

(see instructions)

.

A Total income

............................................................................................

A

(from back page, line 51)

00

.

B New York adjusted gross income from NYAGI worksheet, line 5

......

B

(see instructions on page 10)

00

C Amount from Form IT-205-A, Schedule 1, line 10, column a .......................................................

C

.

00

1 Federal taxable income of fiduciary

.

.........................................................

1

(from back page, line 62)

00

2 New York modifications relating to amounts allocated to principal ..............................................

.

2

00

.

3 Balance

........................................................................................

3

(line 1 and add or subtract line 2)

00

4 Fiduciary’s share of New York fiduciary adjustment

.

...........

4

(from back page, Schedule C, column 5)

00

5 New York taxable income of fiduciary

.

...........................................

5

(line 3 and add or subtract line 4)

00

.

6 State tax on line 5 amount

...................................................

6

(full-year resident estate and trust only)

00

.

7 New York State amount from Form IT-230, Part 2, line 2

................

7

(resident estate and trust only)

00

.

8 Add lines 6 and 7 .........................................................................................................................

8

00

9 Allocated New York State tax

(from Form IT-205-A, Schedule 1, line 13)

• If you completed Form IT-230, Part 2, mark an X in this box

.

..........................................

9

00

.

10 Nonrefundable state credits

............................................................................... 10

(submit schedule)

00

.

11 Subtract line 10 from line 8 or line 9 ............................................................................................ 11

00

.

12 State separate tax on lump-sum distributions and other addbacks ............................................. 12

00

.

13 State minimum income tax .......................................................................................................... 13

00

14 Total New York State tax

................................................. 14

.

(add lines 11, 12, and 13; see instructions)

00

.

15a New York City resident tax on line 5 amount

....... 15a

(see instructions)

00

Make check or money order

.

15b New York City part-year resident tax

............ 15b

(see instructions)

00

payable to NY State Income

.

16 New York City amount from Form IT-230, Part 2, line 2

16

(see instructions)

00

Tax; write the estate or trust’s

.

employer identification number

17 Add line 15a or 15b to line 16 ..............................................

17

00

.

18 New York City accumulation distribution credit ....................

18

and 2013 Fiduciary Income Tax

00

on it; complete Form IT-205-V and

.

19 Subtract line 18 from line 17

......

19

(if less than zero, leave blank)

00

mail it with the payment and the

.

20 New York City separate tax on lump-sum distributions

20

(see instructions)

00

completed return to the appropriate

.

21 Add lines 19 and 20 .............................................................

21

00

address in the instructions.

.

22 New York City - UBT credit

........................

22

(from Form IT-219)

00

.

23 Subtract line 22 from line 21

................................................................. 23

(if less than zero, leave blank)

00

24 New York City minimum income tax

....................................................................... 24

.

(see instructions)

00

.

25 Yonkers resident income tax surcharge from Yonkers worksheet, line e

................ 25

(see instructions)

00

26 Yonkers part-year resident tax

............................. 26

.

(from Form IT-205-A-I, page 4, Worksheet C, line 14)

00

27 Yonkers nonresident fiduciary earnings tax

.......................................................... 27

(from Form Y-206)

.

00

28 Sales or use tax

.

.................................................................................. 28

(see instructions on page 22)

00

.

29 Total NYS, NYC, Yonkers taxes, and sales or use tax

29

(add lines 14 and 23 through 28; see instructions)

00

.

30 Estimated tax paid

..................................................... 30

(including payments made with Form IT-370-PF)

00

31 Estimated tax payments allocated to beneficiaries

.

.......................................... 31

(from Form IT-205-T)

00

.

32 Subtract line 31 from line 30 ............................................................................................................ 32

00

Identify:

.

33 Refundable credits

33

00

.

34 New York State tax withheld ............................................................................................................ 34

00

35 New York City tax withheld .............................................................................................................. 35

.

00

36 Yonkers tax withheld ....................................................................................................................... 36

.

00

.

37 Total

............................................................................................................. 37

(add lines 32 through 36)

00

.

38 If line 37 is more than the total of lines 29 and 42, enter the overpayment

38

00

.

39 Amount of line 38 to be refunded to you .............................. 39

00

.

40 Amount of line 38 to be credited to 2014 estimated tax ........ 40

00

.

41 If line 37 is less than the total of lines 29 and 42, enter amount you owe

41

00

205001130094

.

42 Estimated tax penalty

42

(will reduce line 38 or increase line 41; see instr.)

00

1

1 2

2