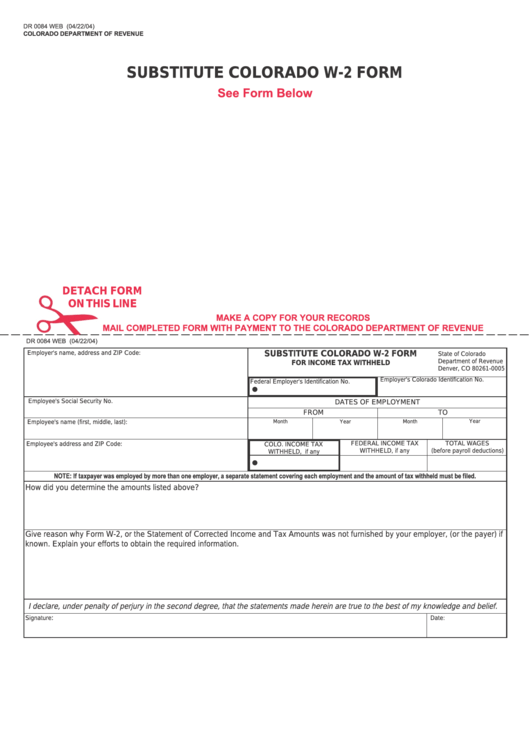

Form Dr 0084 - Substitute Colorado W-2 Form For Income Tax Withheld

ADVERTISEMENT

DR 0084 WEB (04/22/04)

COLORADO DEPARTMENT OF REVENUE

SUBSTITUTE COLORADO W-2 FORM

See Form Below

DETACH FORM

ON THIS LINE

MAKE A COPY FOR YOUR RECORDS

MAIL COMPLETED FORM WITH PAYMENT TO THE COLORADO DEPARTMENT OF REVENUE

DR 0084 WEB (04/22/04)

SUBSTITUTE COLORADO W-2 FORM

Employer's name, address and ZIP Code:

State of Colorado

Department of Revenue

FOR INCOME TAX WITHHELD

Denver, CO 80261-0005

Employer's Colorado Identification No.

Federal Employer's Identification No.

●

Employee's Social Security No.

DATES OF EMPLOYMENT

FROM

TO

Year

Employee's name (first, middle, last):

Month

Year

Month

FEDERAL INCOME TAX

TOTAL WAGES

Employee's address and ZIP Code:

COLO. INCOME TAX

WITHHELD, if any

(before payroll deductions)

WITHHELD, if any

●

NOTE: If taxpayer was employed by more than one employer, a separate statement covering each employment and the amount of tax withheld must be filed.

How did you determine the amounts listed above?

Give reason why Form W-2, or the Statement of Corrected Income and Tax Amounts was not furnished by your employer, (or the payer) if

known. Explain your efforts to obtain the required information.

I declare, under penalty of perjury in the second degree, that the statements made herein are true to the best of my knowledge and belief.

:

Signature

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1