Form F-1157zn - Enterprise Zone Jobs Credit Instructions

ADVERTISEMENT

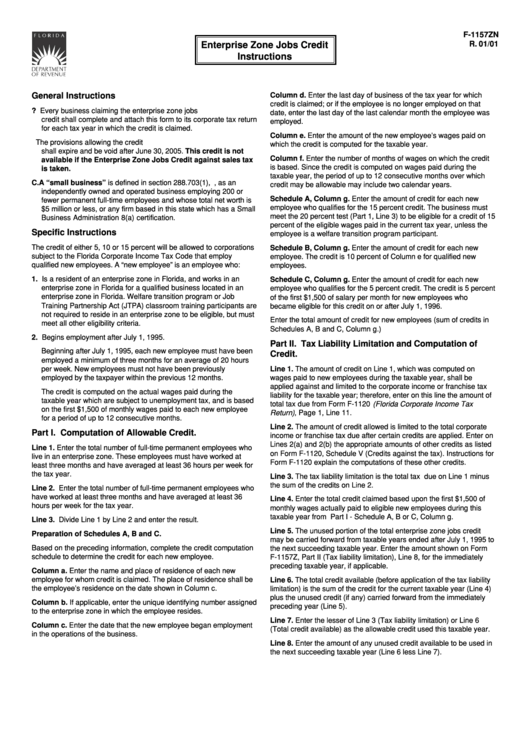

F-1157ZN

R. 01/01

Enterprise Zone Jobs Credit

Instructions

General Instructions

Column d. Enter the last day of business of the tax year for which

credit is claimed; or if the employee is no longer employed on that

A. Who must file? Every business claiming the enterprise zone jobs

date, enter the last day of the last calendar month the employee was

credit shall complete and attach this form to its corporate tax return

employed.

for each tax year in which the credit is claimed.

Column e. Enter the amount of the new employee’s wages paid on

B. When you may take the credit. The provisions allowing the credit

which the credit is computed for the taxable year.

shall expire and be void after June 30, 2005. This credit is not

Column f. Enter the number of months of wages on which the credit

available if the Enterprise Zone Jobs Credit against sales tax

is based. Since the credit is computed on wages paid during the

is taken.

taxable year, the period of up to 12 consecutive months over which

C. A “small business” is defined in section 288.703(1), F.S., as an

credit may be allowable may include two calendar years.

independently owned and operated business employing 200 or

Schedule A, Column g. Enter the amount of credit for each new

fewer permanent full-time employees and whose total net worth is

employee who qualifies for the 15 percent credit. The business must

$5 million or less, or any firm based in this state which has a Small

meet the 20 percent test (Part 1, Line 3) to be eligible for a credit of 15

Business Administration 8(a) certification.

percent of the eligible wages paid in the current tax year, unless the

Specific Instructions

employee is a welfare transition program participant.

The credit of either 5, 10 or 15 percent will be allowed to corporations

Schedule B, Column g. Enter the amount of credit for each new

subject to the Florida Corporate Income Tax Code that employ

employee. The credit is 10 percent of Column e for qualified new

qualified new employees. A “new employee” is an employee who:

employees.

1. Is a resident of an enterprise zone in Florida, and works in an

Schedule C, Column g. Enter the amount of credit for each new

enterprise zone in Florida for a qualified business located in an

employee who qualifies for the 5 percent credit. The credit is 5 percent

enterprise zone in Florida. Welfare transition program or Job

of the first $1,500 of salary per month for new employees who

Training Partnership Act (JTPA) classroom training participants are

became eligible for this credit on or after July 1, 1996.

not required to reside in an enterprise zone to be eligible, but must

Enter the total amount of credit for new employees (sum of credits in

meet all other eligibility criteria.

Schedules A, B and C, Column g.)

2. Begins employment after July 1, 1995.

Part II. Tax Liability Limitation and Computation of

Beginning after July 1, 1995, each new employee must have been

Credit.

employed a minimum of three months for an average of 20 hours

per week. New employees must not have been previously

Line 1. The amount of credit on Line 1, which was computed on

employed by the taxpayer within the previous 12 months.

wages paid to new employees during the taxable year, shall be

applied against and limited to the corporate income or franchise tax

The credit is computed on the actual wages paid during the

liability for the taxable year; therefore, enter on this line the amount of

taxable year which are subject to unemployment tax, and is based

total tax due from Form F-1120 (Florida Corporate Income Tax

on the first $1,500 of monthly wages paid to each new employee

Return) , Page 1, Line 11.

for a period of up to 12 consecutive months.

Line 2. The amount of credit allowed is limited to the total corporate

Part I. Computation of Allowable Credit.

income or franchise tax due after certain credits are applied. Enter on

Lines 2(a) and 2(b) the appropriate amounts of other credits as listed

Line 1. Enter the total number of full-time permanent employees who

on Form F-1120, Schedule V (Credits against the tax). Instructions for

live in an enterprise zone. These employees must have worked at

Form F-1120 explain the computations of these other credits.

least three months and have averaged at least 36 hours per week for

the tax year.

Line 3. The tax liability limitation is the total tax due on Line 1 minus

the sum of the credits on Line 2.

Line 2. Enter the total number of full-time permanent employees who

have worked at least three months and have averaged at least 36

Line 4. Enter the total credit claimed based upon the first $1,500 of

hours per week for the tax year.

monthly wages actually paid to eligible new employees during this

taxable year from Part I - Schedule A, B or C, Column g.

Line 3. Divide Line 1 by Line 2 and enter the result.

Line 5. The unused portion of the total enterprise zone jobs credit

Preparation of Schedules A, B and C.

may be carried forward from taxable years ended after July 1, 1995 to

Based on the preceding information, complete the credit computation

the next succeeding taxable year. Enter the amount shown on Form

schedule to determine the credit for each new employee.

F-1157Z, Part II (Tax liability limitation), Line 8, for the immediately

preceding taxable year, if applicable.

Column a. Enter the name and place of residence of each new

employee for whom credit is claimed. The place of residence shall be

Line 6. The total credit available (before application of the tax liability

the employee’s residence on the date shown in Column c.

limitation) is the sum of the credit for the current taxable year (Line 4)

plus the unused credit (if any) carried forward from the immediately

Column b. If applicable, enter the unique identifying number assigned

preceding year (Line 5).

to the enterprise zone in which the employee resides.

Line 7. Enter the lesser of Line 3 (Tax liability limitation) or Line 6

Column c. Enter the date that the new employee began employment

(Total credit available) as the allowable credit used this taxable year.

in the operations of the business.

Line 8. Enter the amount of any unused credit available to be used in

the next succeeding taxable year (Line 6 less Line 7).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1