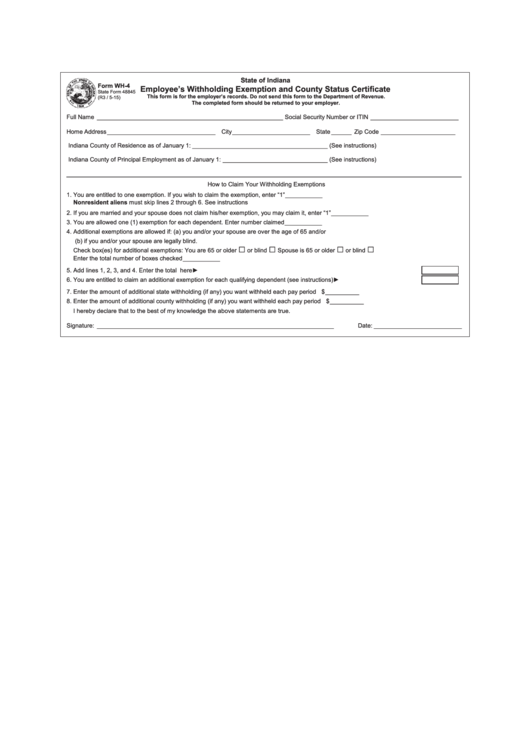

State of Indiana

Form WH-4

Employee’s Withholding Exemption and County Status Certificate

State Form 48845

This form is for the employer’s records. Do not send this form to the Department of Revenue.

(R3 / 5-15)

The completed form should be returned to your employer.

Full Name _______________________________________________________

Social Security Number or ITIN __________________________

Home Address ________________________________

City _______________________

State ______

Zip Code ______________________

Indiana County of Residence as of January 1: ________________________________________

(See instructions)

Indiana County of Principal Employment as of January 1: _______________________________

(See instructions)

___________________________________________________________________________

How to Claim Your Withholding Exemptions

1. You are entitled to one exemption. If you wish to claim the exemption, enter “1” ..............................................................................

___________

Nonresident aliens must skip lines 2 through 6. See instructions

2. If you are married and your spouse does not claim his/her exemption, you may claim it, enter “1” ...................................................

___________

3. You are allowed one (1) exemption for each dependent. Enter number claimed ...............................................................................

___________

4. Additional exemptions are allowed if: (a) you and/or your spouse are over the age of 65 and/or

(b) if you and/or your spouse are legally blind.

□

□

□

□

Check box(es) for additional exemptions: You are 65 or older

or blind

Spouse is 65 or older

or blind

Enter the total number of boxes checked ...........................................................................................................................................

___________

5. Add lines 1, 2, 3, and 4. Enter the total here ..................................................................................................................................... ►

6. You are entitled to claim an additional exemption for each qualifying dependent (see instructions) .................................................. ►

7. Enter the amount of additional state withholding (if any) you want withheld each pay period ...........................................................

$ __________

8. Enter the amount of additional county withholding (if any) you want withheld each pay period .........................................................

$ __________

I hereby declare that to the best of my knowledge the above statements are true.

Signature: ______________________________________________________________________

Date: __________________________

1

1