Reset Form

Michigan Department of Treasury (Rev. 08-12), Page 1

Issued under authority of Public Act 281 of 1967.

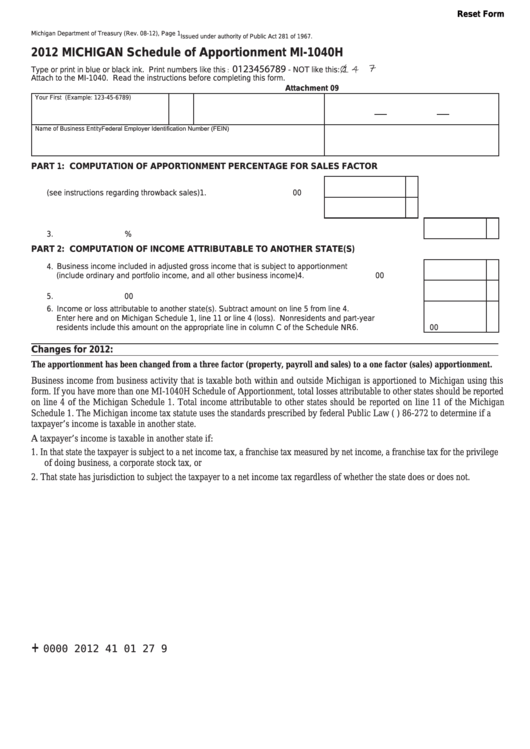

2012 MICHIGAN Schedule of Apportionment MI-1040H

1 4

0123456789

Type or print in blue or black ink. Print numbers like this

- NOT like this:

:

Attach to the MI-1040. Read the instructions before completing this form.

Attachment 09

Your First Name

M.I.

Last Name

Your Social Security Number (Example: 123-45-6789)

Federal Employer Identification Number (FEIN)

Name of Business Entity

PART 1: COMPUTATION OF APPORTIONMENT PERCENTAGE FOR SALES FACTOR

1. Michigan sales (see instructions regarding throwback sales) .................

1.

00

2. Total sales................................................................................................

2.

00

3. Percentage. Divide line 1 by line 2. ........................................................................................................

3.

%

PART 2: COMPUTATION OF INCOME ATTRIBUTABLE TO ANOTHER STATE(S)

4. Business income included in adjusted gross income that is subject to apportionment

(include ordinary and portfolio income, and all other business income) ................................................. 4.

00

5. Multiply the amount on line 4 by the percentage on line 3. .................................................................... 5.

00

6. Income or loss attributable to another state(s). Subtract amount on line 5 from line 4.

Enter here and on Michigan Schedule 1, line 11 or line 4 (loss). Nonresidents and part-year

residents include this amount on the appropriate line in column C of the Schedule NR ........................ 6.

00

Changes for 2012:

The apportionment has been changed from a three factor (property, payroll and sales) to a one factor (sales) apportionment.

Business income from business activity that is taxable both within and outside Michigan is apportioned to Michigan using this

form. If you have more than one MI-1040H Schedule of Apportionment, total losses attributable to other states should be reported

on line 4 of the Michigan Schedule 1. Total income attributable to other states should be reported on line 11 of the Michigan

Schedule 1. The Michigan income tax statute uses the standards prescribed by federal Public Law (P.L.) 86-272 to determine if a

taxpayer’s income is taxable in another state.

A taxpayer’s income is taxable in another state if:

1. In that state the taxpayer is subject to a net income tax, a franchise tax measured by net income, a franchise tax for the privilege

of doing business, a corporate stock tax, or

2. That state has jurisdiction to subject the taxpayer to a net income tax regardless of whether the state does or does not.

+

0000 2012 41 01 27 9

1

1 2

2