Reset Form

Print Form

Questions? Contact us at:

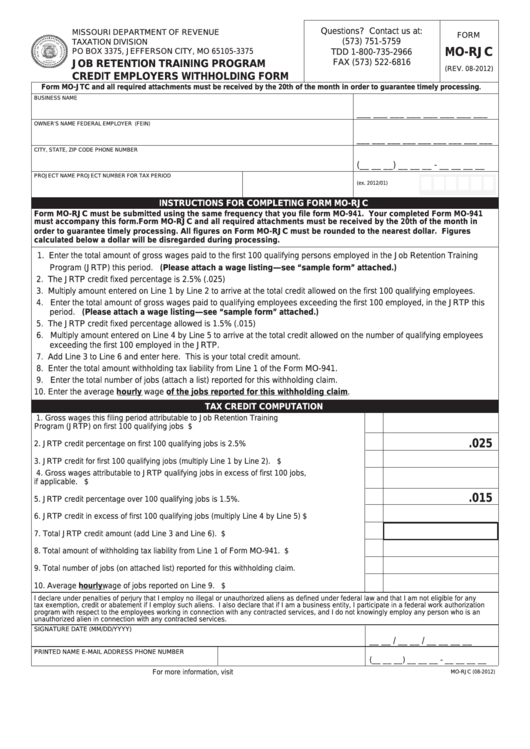

MISSOURI DEPARTMENT OF REVENUE

FORM

(573) 751-5759

TAXATION DIVISION

MO-RJC

PO BOX 3375, JEFFERSON CITY, MO 65105-3375

TDD 1-800-735-2966

FAX (573) 522-6816

JOB RETENTION TRAINING PROGRAM

(REV. 08-2012)

withholdingproject@dor.mo.gov

CREDIT EMPLOYERS WITHHOLDING FORM

Form MO-JTC and all required attachments must be received by the 20th of the month in order to guarantee timely processing

.

BUSINESS NAME

MO.TAX I.D. NUMBER

___ ___ ___ ___ ___ ___ ___ ___

OWNER’S NAME

FEDERAL EMPLOYER I.D. NUMBER (FEIN)

___ ___ ___ ___ ___ ___ ___ ___ ___

CITY, STATE, ZIP CODE

PHONE NUMBER

(__ __ __) __ __ __ - __ __ __ __

PROJECT NAME

PROJECT NUMBER

FOR TAX PERIOD

(ex. 2012/01)

INSTRUCTIONS FOR COMPLETING FORM MO-RJC

Form MO-RJC must be submitted using the same frequency that you file form MO-941. Your completed Form MO-941

must accompany this form. Form MO-RJC and all required attachments must be received by the 20th of the month in

order to guarantee timely processing. All figures on Form MO-RJC must be rounded to the nearest dollar. Figures

calculated below a dollar will be disregarded during processing.

1. Enter the total amount of gross wages paid to the first 100 qualifying persons employed in the Job Retention Training

Program (JRTP) this period. (Please attach a wage listing—see “sample form” attached.)

2. The JRTP credit fixed percentage is 2.5% (.025)

3. Multiply amount entered on Line 1 by Line 2 to arrive at the total credit allowed on the first 100 qualifying employees.

4. Enter the total amount of gross wages paid to qualifying employees exceeding the first 100 employed, in the JRTP this

period. (Please attach a wage listing—see “sample form” attached.)

5. The JRTP credit fixed percentage allowed is 1.5% (.015)

6. Multiply amount entered on Line 4 by Line 5 to arrive at the total credit allowed on the number of qualifying employees

exceeding the first 100 employed in the JRTP.

7. Add Line 3 to Line 6 and enter here. This is your total credit amount.

8. Enter the total amount withholding tax liability from Line 1 of the Form MO-941.

9. Enter the total number of jobs (attach a list) reported for this withholding claim.

10. Enter the average hourly wage of the jobs reported for this withholding claim.

TAX CREDIT COMPUTATION

1. Gross wages this filing period attributable to Job Retention Training

Program (JRTP) on first 100 qualifying jobs ..........................................................................

1

$

.025

2. JRTP credit percentage on first 100 qualifying jobs is 2.5% .................................................

2

3. JRTP credit for first 100 qualifying jobs (multiply Line 1 by Line 2). ....................................

3

$

4. Gross wages attributable to JRTP qualifying jobs in excess of first 100 jobs,

if applicable. ..........................................................................................................................

4

$

.015

5. JRTP credit percentage over 100 qualifying jobs is 1.5%. ...................................................

5

6. JRTP credit in excess of first 100 qualifying jobs (multiply Line 4 by Line 5)........................

6

$

7. Total JRTP credit amount (add Line 3 and Line 6). ..............................................................

7

$

8. Total amount of withholding tax liability from Line 1 of Form MO-941. .................................

8

$

9. Total number of jobs (on attached list) reported for this withholding claim. .........................

9

10. Average hourly wage of jobs reported on Line 9. ................................................................

10

$

I declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any

tax exemption, credit or abatement if I employ such aliens. I also declare that if I am a business entity, I participate in a federal work authorization

program with respect to the employees working in connection with any contracted services, and I do not knowingly employ any person who is an

unauthorized alien in connection with any contracted services.

SIGNATURE

DATE (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

PRINTED NAME

E-MAIL ADDRESS

PHONE NUMBER

(__ __ __) __ __ __ - __ __ __ __

For more information, visit

MO-RJC (08-2012)

1

1 2

2