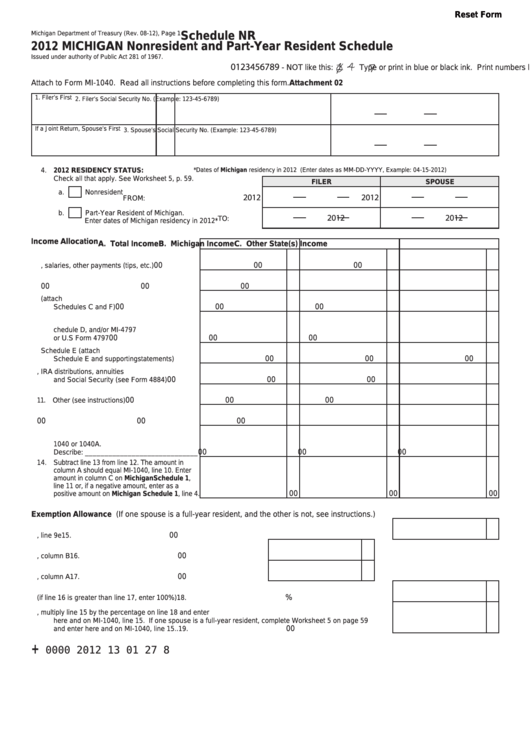

Reset Form

Michigan Department of Treasury (Rev. 08-12), Page 1

Schedule NR

2012 MICHIGAN Nonresident and Part-Year Resident Schedule

Issued under authority of Public Act 281 of 1967.

1 4

0123456789

Type or print in blue or black ink. Print numbers like this:

- NOT like this:

Attach to Form MI-1040. Read all instructions before completing this form.

Attachment 02

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Social Security No. (Example: 123-45-6789)

4. 2012 RESIDENCY STATUS:

*Dates of Michigan residency in 2012 (Enter dates as MM-DD-YYYY, Example: 04-15-2012)

Check all that apply. See Worksheet 5, p. 59.

FILER

SPOUSE

a.

Nonresident

2012

2012

FROM:

b.

Part-Year Resident of Michigan.

2012

2012

TO:

Enter dates of Michigan residency in 2012*

Income Allocation

A. Total Income

B. Michigan Income

C. Other State(s) Income

00

00

00

5. Wages, salaries, other payments (tips, etc.) .....

00

00

00

6. Interest and dividends .......................................

7. Business and farm income (attach U.S.

00

00

00

Schedules C and F) ...........................................

8. Gains/losses from MI-1040D or

U.S. Schedule D, and/or MI-4797

00

00

00

or U.S Form 4797 ..............................................

9. Income reported on U.S. Schedule E (attach

00

00

00

U.S. Schedule E and supporting statements)....

10. Pensions, IRA distributions, annuities

00

00

00

and Social Security (see Form 4884) ................

00

00

00

11. Other (see instructions) .....................................

00

00

00

12. Total income. Add lines 5 through 11 .................

13. Enter the total adjustments from U.S. Form

1040 or 1040A.

00

00

00

Describe: _____________________________

14. Subtract line 13 from line 12. The amount in

column A should equal MI-1040, line 10. Enter

amount in column C on Michigan Schedule 1,

line 11 or, if a negative amount, enter as a

00

00

00

positive amount on Michigan Schedule 1, line 4.

Exemption Allowance (If one spouse is a full-year resident, and the other is not, see instructions.)

00

15. Enter amount from MI-1040, line 9e .............................................................................................................

15.

00

16. Enter Michigan source income from line 14, column B ...............

16.

00

17. Enter total income from line 14, column A ...................................

17.

%

18. Divide line 16 by line 17 (if line 16 is greater than line 17, enter 100%) .......................................................

18.

19. If both spouses are part-year or non-residents, multiply line 15 by the percentage on line 18 and enter

here and on MI-1040, line 15. If one spouse is a full-year resident, complete Worksheet 5 on page 59

00

and enter here and on MI-1040, line 15.. .....................................................................................................

19.

+

0000 2012 13 01 27 8

1

1 2

2