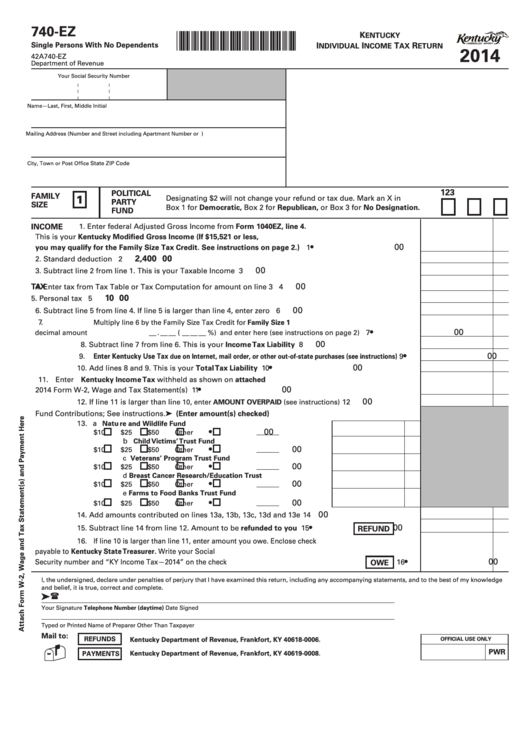

740-EZ

K

*1400030003*

ENTUCKY

Single Persons With No Dependents

I

I

T

R

NDIVIDUAL

NCOME

AX

ETURN

2014

42A740-EZ

Department of Revenue

Your Social Security Number

Name—Last, First, Middle Initial

Mailing Address (Number and Street including Apartment Number or P .O. Box)

State

ZIP Code

City, Town or Post Office

1

2

3

POLITICAL

FAMILY

1

Designating $2 will not change your refund or tax due. Mark an X in

PARTY

SIZE

Box 1 for Democratic, Box 2 for Republican, or Box 3 for No Designation.

FUND

INCOME

1. Enter federal Adjusted Gross Income from Form 1040EZ, line 4.

This is your Kentucky Modified Gross Income

(

If $15,521 or less,

•

00

you may qualify for the Family Size Tax Credit. See instructions on page 2.) ..................

1

2,400 00

2. Standard deduction ................................................................................................................

2

00

3. Subtract line 2 from line 1. This is your Taxable Income .....................................................

3

00

TAX

4. Enter tax from Tax Table or Tax Computation for amount on line 3 .....................................

4

10 00

5. Personal tax credit...................................................................................................................

5

00

6. Subtract line 5 from line 4. If line 5 is larger than line 4, enter zero ...................................

6

7.

Multiply line 6 by the Family Size Tax Credit for Family Size 1

•

00

decimal amount

__ . __ __

(

__ __ __

%) and enter here (see instructions on page 2) .................

7

00

8. Subtract line 7 from line 6. This is your Income Tax Liability ..............................................

8

•

00

9. Enter Kentucky Use Tax

9

due on Internet, mail order, or other out-of-state purchases (see instructions)

•

00

10. Add lines 8 and 9. This is your Total Tax Liability ................................................................. 10

11. Enter Kentucky Income Tax withheld as shown on attached

•

00

2014 Form W-2, Wage and Tax Statement(s) .......................................................................... 11

00

12. If line 11 is larger than li

ne 10, enter AMOUNT OVERPAID (see instructions) ..........................

12

Fund Contributions; See instructions. ............................... ➤ (Enter amount(s) checked)

13. a

Natu re and Wildlife Fund

•

00

$10

$25

$50

Other

....................

b

Child Victims’ Trust Fund

•

00

$10

$25

$50

Other

....................

c Veterans’ Program Trust Fund

•

00

$10

$25

$50

Other

....................

d Breast Cancer Research/Education Trust

•

00

$10

$25

$50

Other

....................

e Farms to Food Banks Trust Fund

•

00

$10

$25

$50

Other

....................

00

14. Add amounts contributed on lines 13a, 13b, 13c, 13d and 13e ........................................... 14

•

00

15. Subtract line 14 from line 12. Amount to be refunded to you ...................

15

REFUND

16. If line 10 is larger than line 11, enter amount you owe. Enclose check

payable to Kentucky State Treasurer. Write your Social

•

00

Security number and “KY Income Tax—2014” on the check .....................................

16

OWE

I, the undersigned, declare under penalties of perjury that I have examined this return, including any accompanying statements, and to the best of my knowledge

and belief, it is true, correct and complete.

Your Signature

Date Signed

Telephone Number (daytime)

Typed or Printed Name of Preparer Other Than Taxpayer

I.D. Number of Preparer

Date

Mail to:

REFUNDS

Kentucky Department of Revenue, Frankfort, KY 40618-0006.

OFFICIAL USE ONLY

PWR

PAYMENTS

Kentucky Department of Revenue, Frankfort, KY 40619-0008.

1

1 2

2