Form Dr 0102 - Claim For Refund On Behalf Of Deceased Taxpayer

ADVERTISEMENT

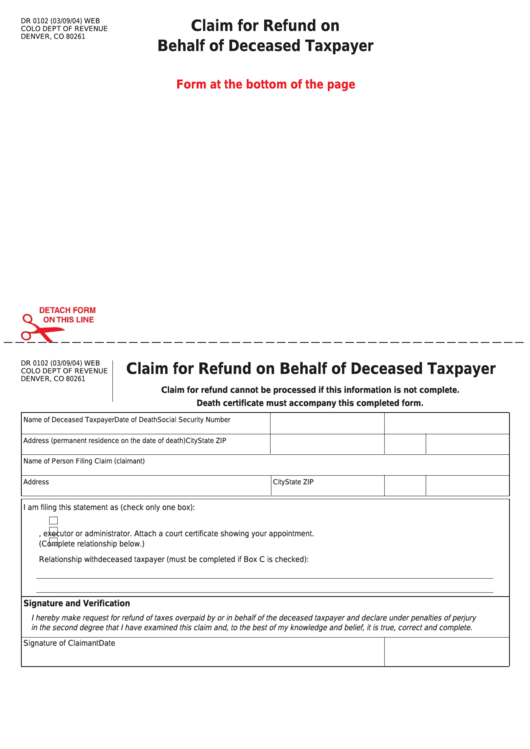

DR 0102 (03/09/04) WEB

Claim for Refund on

COLO DEPT OF REVENUE

DENVER, CO 80261

Behalf of Deceased Taxpayer

Form at the bottom of the page

DR 0102 (03/09/04) WEB

Claim for Refund on Behalf of Deceased Taxpayer

COLO DEPT OF REVENUE

DENVER, CO 80261

Claim for refund cannot be processed if this information is not complete.

Death certificate must accompany this completed form.

Name of Deceased Taxpayer

Date of Death

Social Security Number

Address (permanent residence on the date of death)

City

State

ZIP

Name of Person Filing Claim (claimant)

Address

City

State

ZIP

I am filing this statement as (check only one box):

A.

Surviving wife or husband.

B.

Personal representative, executor or administrator. Attach a court certificate showing your appointment.

C.

Claimant for the estate of the decedent where there is no court estate proceeding. (Complete relationship below.)

Relationship with deceased taxpayer (must be completed if Box C is checked):

Signature and Verification

I hereby make request for refund of taxes overpaid by or in behalf of the deceased taxpayer and declare under penalties of perjury

in the second degree that I have examined this claim and, to the best of my knowledge and belief, it is true, correct and complete.

Signature of Claimant

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1