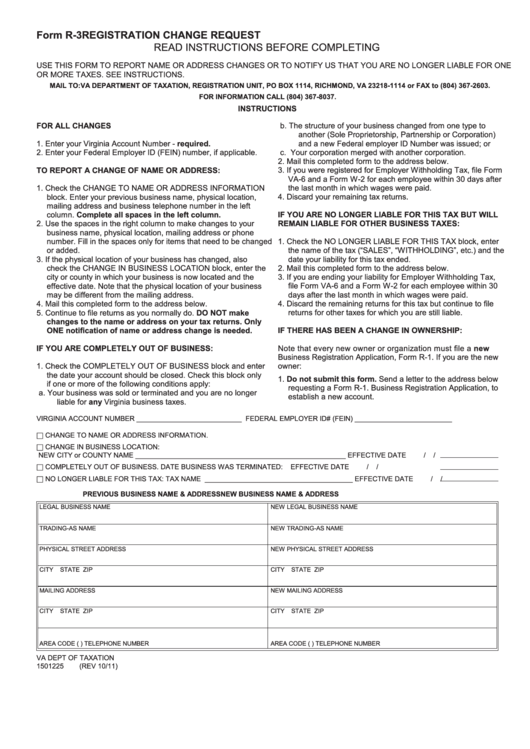

Form R-3

REGISTRATION CHANGE REQUEST

READ INSTRUCTIONS BEFORE COMPLETING

USE THIS FORM TO REPORT NAME OR ADDRESS CHANGES OR TO NOTIFY US THAT YOU ARE NO LONGER LIABLE FOR ONE

OR MORE TAXES. SEE INSTRUCTIONS.

MAIL TO: VA DEPARTMENT OF TAXATION, REGISTRATION UNIT, PO BOX 1114, RICHMOND, VA 23218-1114 or FAX to (804) 367-2603.

FOR INFORMATION CALL (804) 367-8037.

INSTRUCTIONS

FOR ALL CHANGES

b. The structure of your business changed from one type to

another (Sole Proprietorship, Partnership or Corporation)

1. Enter your Virginia Account Number - required.

and a new Federal employer ID Number was issued; or

2. Enter your Federal Employer ID (FEIN) number, if applicable.

c. Your corporation merged with another corporation.

2. Mail this completed form to the address below.

TO REPORT A CHANGE OF NAME OR ADDRESS:

3. If you were registered for Employer Withholding Tax, file Form

VA-6 and a Form W-2 for each employee within 30 days after

the last month in which wages were paid.

1. Check the CHANGE TO NAME OR ADDRESS INFORMATION

block. Enter your previous business name, physical location,

4. Discard your remaining tax returns.

mailing address and business telephone number in the left

IF YOU ARE NO LONGER LIABLE FOR THIS TAX BUT WILL

column. Complete all spaces in the left column.

2. Use the spaces in the right column to make changes to your

REMAIN LIABLE FOR OTHER BUSINESS TAXES:

business name, physical location, mailing address or phone

1. Check the NO LONGER LIABLE FOR THIS TAX block, enter

number. Fill in the spaces only for items that need to be changed

or added.

the name of the tax (“SALES”, “WITHHOLDING”, etc.) and the

3. If the physical location of your business has changed, also

date your liability for this tax ended.

check the CHANGE IN BUSINESS LOCATION block, enter the

2. Mail this completed form to the address below.

city or county in which your business is now located and the

3. If you are ending your liability for Employer Withholding Tax,

effective date. Note that the physical location of your business

file Form VA-6 and a Form W-2 for each employee within 30

may be different from the mailing address.

days after the last month in which wages were paid.

4. Mail this completed form to the address below.

4. Discard the remaining returns for this tax but continue to file

5. Continue to file returns as you normally do. DO NOT make

returns for other taxes for which you are still liable.

changes to the name or address on your tax returns. Only

ONE notification of name or address change is needed.

IF THERE HAS BEEN A CHANGE IN OWNERSHIP:

IF YOU ARE COMPLETELY OUT OF BUSINESS:

Note that every new owner or organization must file a new

Business Registration Application, Form R-1. If you are the new

owner:

1. Check the COMPLETELY OUT OF BUSINESS block and enter

the date your account should be closed. Check this block only

1. Do not submit this form. Send a letter to the address below

if one or more of the following conditions apply:

requesting a Form R-1. Business Registration Application, to

a. Your business was sold or terminated and you are no longer

establish a new account.

liable for any Virginia business taxes.

VIRGINIA ACCOUNT NUMBER ___________________________

FEDERAL EMPLOYER ID# (FEIN) _________________________

h CHANGE TO NAME OR ADDRESS INFORMATION.

h CHANGE IN BUSINESS LOCATION:

NEW CITY or COUNTY NAME ______________________________________________________

EFFECTIVE DATE

/

/

h COMPLETELY OUT OF BUSINESS. DATE BUSINESS WAS TERMINATED:

EFFECTIVE DATE

/

/

h NO LONGER LIABLE FOR THIS TAX: TAX NAME ______________________________________

EFFECTIVE DATE

/

/

PREVIOUS BUSINESS NAME & ADDRESS

NEW BUSINESS NAME & ADDRESS

LEGAL BUSINESS NAME

NEW LEGAL BUSINESS NAME

TRADING-AS NAME

NEW TRADING-AS NAME

PHYSICAL STREET ADDRESS

NEW PHYSICAL STREET ADDRESS

CITY

STATE

ZIP

CITY

STATE

ZIP

MAILING ADDRESS

NEW MAILING ADDRESS

CITY

STATE

ZIP

CITY

STATE

ZIP

AREA CODE (

) TELEPHONE NUMBER

AREA CODE (

) TELEPHONE NUMBER

VA DEPT OF TAXATION

1501225

(REV 10/11)

1

1