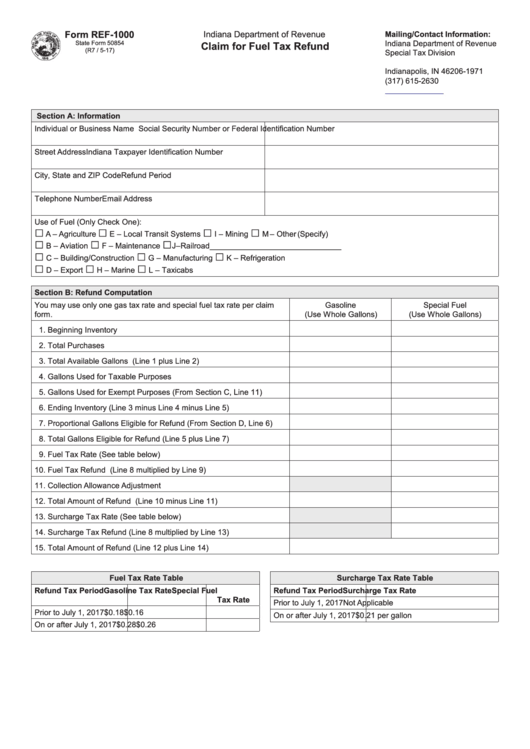

Form REF-1000

Indiana Department of Revenue

Mailing/Contact Information:

Indiana Department of Revenue

State Form 50854

Claim for Fuel Tax Refund

(R7 / 5-17)

Special Tax Division

P.O. Box 1971

Indianapolis, IN 46206-1971

(317) 615-2630

fetax@dor.in.gov

Section A: Information

Individual or Business Name

Social Security Number or Federal Identification Number

Street Address

Indiana Taxpayer Identification Number

City, State and ZIP Code

Refund Period

Telephone Number

Email Address

Use of Fuel (Only Check One):

□

□

□

□

A – Agriculture

E – Local Transit Systems

I – Mining

M – Other (Specify)

□

□

□

B – Aviation

F – Maintenance

J – Railroad

______________________________

□

□

□

C – Building/Construction

G – Manufacturing

K – Refrigeration

□

□

□

D – Export

H – Marine

L – Taxicabs

Section B: Refund Computation

You may use only one gas tax rate and special fuel tax rate per claim

Gasoline

Special Fuel

form.

(Use Whole Gallons)

(Use Whole Gallons)

1. Beginning Inventory

2. Total Purchases

3. Total Available Gallons (Line 1 plus Line 2)

4. Gallons Used for Taxable Purposes

5. Gallons Used for Exempt Purposes (From Section C, Line 11)

6. Ending Inventory (Line 3 minus Line 4 minus Line 5)

7. Proportional Gallons Eligible for Refund (From Section D, Line 6)

8. Total Gallons Eligible for Refund (Line 5 plus Line 7)

9. Fuel Tax Rate (See table below)

10. Fuel Tax Refund (Line 8 multiplied by Line 9)

11. Collection Allowance Adjustment

12. Total Amount of Refund (Line 10 minus Line 11)

13. Surcharge Tax Rate (See table below)

14. Surcharge Tax Refund (Line 8 multiplied by Line 13)

15. Total Amount of Refund (Line 12 plus Line 14)

Fuel Tax Rate Table

Surcharge Tax Rate Table

Refund Tax Period

Gasoline Tax Rate

Special Fuel

Refund Tax Period

Surcharge Tax Rate

Tax Rate

Prior to July 1, 2017

Not Applicable

Prior to July 1, 2017

$0.18

$0.16

On or after July 1, 2017

$0.21 per gallon

On or after July 1, 2017

$0.28

$0.26

1

1 2

2 3

3