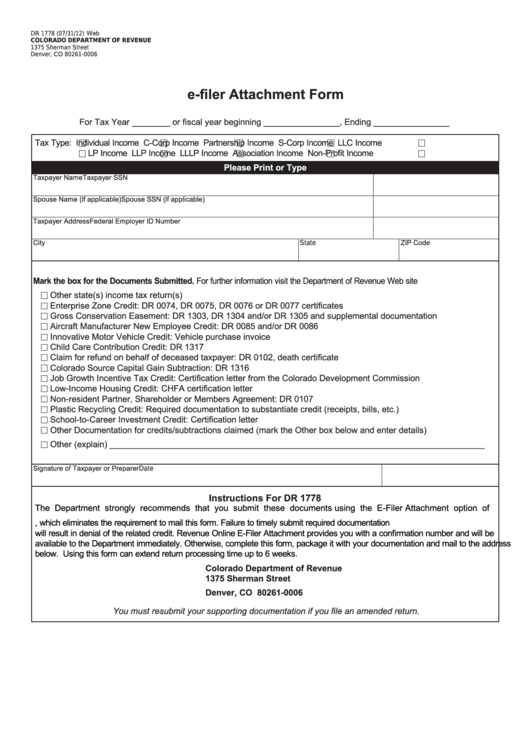

Web

DR 1778 (07/31/12)

COLORADO DEPARTMENT OF REVENUE

1375 Sherman Street

Denver, CO 80261-0006

e-filer Attachment Form

For Tax Year ________ or fiscal year beginning ________________, Ending ________________

Tax Type:

Individual Income

C-Corp Income

Partnership Income

S-Corp Income

LLC Income

LP Income

LLP Income

LLLP Income

Association Income

Non-Profit Income

Please Print or Type

Taxpayer Name

Taxpayer SSN

Spouse Name (if applicable)

Spouse SSN (if applicable)

Taxpayer Address

Federal Employer ID Number

City

ZIP Code

State

Mark the box for the Documents Submitted. For further information visit the Department of Revenue Web site

Other state(s) income tax return(s)

Enterprise Zone Credit: DR 0074, DR 0075, DR 0076 or DR 0077 certificates

Gross Conservation Easement: DR 1303, DR 1304 and/or DR 1305 and supplemental documentation

Aircraft Manufacturer New Employee Credit: DR 0085 and/or DR 0086

Innovative Motor Vehicle Credit: Vehicle purchase invoice

Child Care Contribution Credit: DR 1317

Claim for refund on behalf of deceased taxpayer: DR 0102, death certificate

Colorado Source Capital Gain Subtraction: DR 1316

Job Growth Incentive Tax Credit: Certification letter from the Colorado Development Commission

Low-Income Housing Credit: CHFA certification letter

Non-resident Partner, Shareholder or Members Agreement: DR 0107

Plastic Recycling Credit: Required documentation to substantiate credit (receipts, bills, etc.)

School-to-Career Investment Credit: Certification letter

Other Documentation for credits/subtractions claimed (mark the Other box below and enter details)

Other (explain) _______________________________________________________________________________

Signature of Taxpayer or Preparer

Date

Instructions For DR 1778

The Department strongly recommends that you submit these documents using the E-Filer Attachment option of

, which eliminates the requirement to mail this form. Failure to timely submit required documentation

will result in denial of the related credit. Revenue Online E-Filer Attachment provides you with a confirmation number and will be

available to the Department immediately. Otherwise, complete this form, package it with your documentation and mail to the address

below. Using this form can extend return processing time up to 6 weeks.

Colorado Department of Revenue

1375 Sherman Street

Denver, CO 80261-0006

You must resubmit your supporting documentation if you file an amended return.

1

1