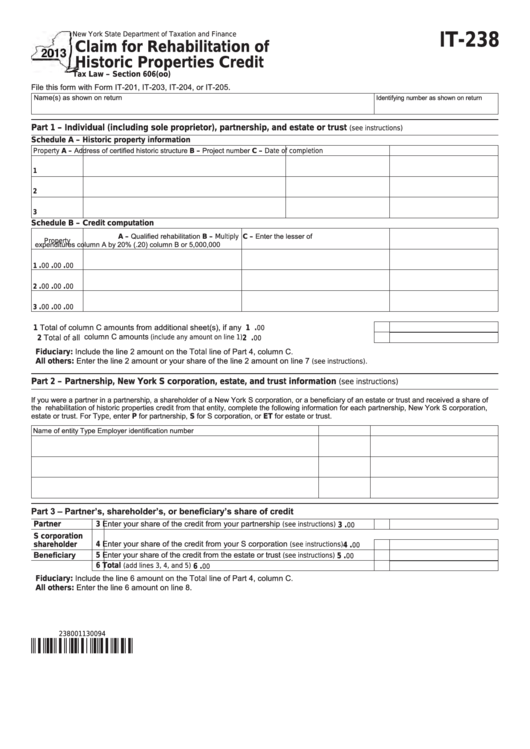

New York State Department of Taxation and Finance

IT-238

Claim for Rehabilitation of

Historic Properties Credit

Tax Law – Section 606(oo)

File this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Identifying number as shown on return

Part 1 – Individual (including sole proprietor), partnership, and estate or trust

(see instructions)

Schedule A – Historic property information

A – Address of certified historic structure

B – Project number

Property

C – Date of completion

1

2

3

Schedule B – Credit computation

A – Qualified rehabilitation

C – Enter the lesser of

B – Multiply

Property

expenditures

column A by 20% (.20)

column B or 5,000,000

.

.

.

1

00

00

00

.

.

.

2

00

00

00

.

.

.

3

00

00

00

1 Total of column C amounts from additional sheet(s), if any .........................................................

.

1

00

2 Total of all column C amounts

...........................................................

.

2

(include any amount on line 1)

00

Fiduciary: Include the line 2 amount on the Total line of Part 4, column C.

All others: Enter the line 2 amount or your share of the line 2 amount on line 7

.

(see instructions)

Part 2 – Partnership, New York S corporation, estate, and trust information

(see instructions)

If you were a partner in a partnership, a shareholder of a New York S corporation, or a beneficiary of an estate or trust and received a share of

the rehabilitation of historic properties credit from that entity, complete the following information for each partnership, New York S corporation,

estate or trust. For Type, enter P for partnership, S for S corporation, or ET for estate or trust.

Name of entity

Type

Employer identification number

Part 3 – Partner’s, shareholder’s, or beneficiary’s share of credit

3 Enter your share of the credit from your partnership

.............

Partner

.

(see instructions)

3

00

S corporation

4 Enter your share of the credit from your S corporation

..........

shareholder

(see instructions)

.

4

00

Beneficiary

5 Enter your share of the credit from the estate or trust

..............

.

(see instructions)

5

00

................................................................................

6 Total

.

(add lines 3, 4, and 5)

6

00

Fiduciary: Include the line 6 amount on the Total line of Part 4, column C.

All others: Enter the line 6 amount on line 8.

238001130094

1

1 2

2