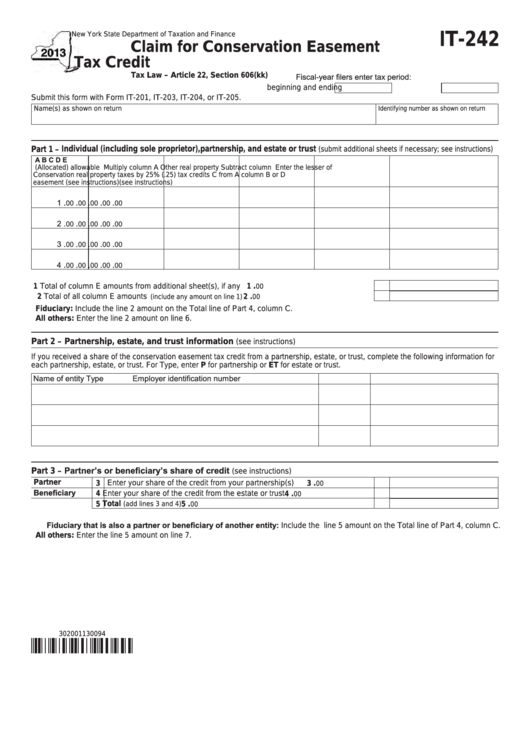

New York State Department of Taxation and Finance

IT-242

Claim for Conservation Easement

Tax Credit

Fiscal-year filers enter tax period:

Tax Law – Article 22, Section 606(kk)

beginning

and ending

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Identifying number as shown on return

Part 1

Individual (including sole proprietor), partnership, and estate or trust

–

(submit additional sheets if necessary; see instructions)

A

B

C

D

E

(Allocated) allowable

Multiply column A

Other real property

Subtract column

Enter the lesser of

Conservation

real property taxes

by 25% (.25)

tax credits

C from A

column B or D

easement

(see instructions)

(see instructions)

.

.

.

.

.

1

00

00

00

00

00

.

.

.

.

.

2

00

00

00

00

00

.

.

.

.

.

3

00

00

00

00

00

.

.

.

.

.

4

00

00

00

00

00

1 Total of column E amounts from additional sheet(s), if any .........................................................

00

.

1

2 Total of all column E amounts

..........................................................

00

.

2

(include any amount on line 1)

Fiduciary: Include the line 2 amount on the Total line of Part 4, column C.

All others: Enter the line 2 amount on line 6.

Part 2

Partnership, estate, and trust information

–

(see instructions)

If you received a share of the conservation easement tax credit from a partnership, estate, or trust, complete the following information for

each partnership, estate, or trust. For Type, enter P for partnership or ET for estate or trust.

Name of entity

Type

Employer identification number

Partner’s or beneficiary’s share of credit

Part 3

–

(see instructions)

3 Enter your share of the credit from your partnership(s) ...................................

00

Partner

.

3

Beneficiary

4 Enter your share of the credit from the estate or trust .....................................

00

.

4

.....................................................................................

00

5 Total

.

(add lines 3 and 4)

5

Fiduciary that is also a partner or beneficiary of another entity: Include the line 5 amount on the Total line of Part 4, column C.

All others: Enter the line 5 amount on line 7.

302001130094

1

1 2

2