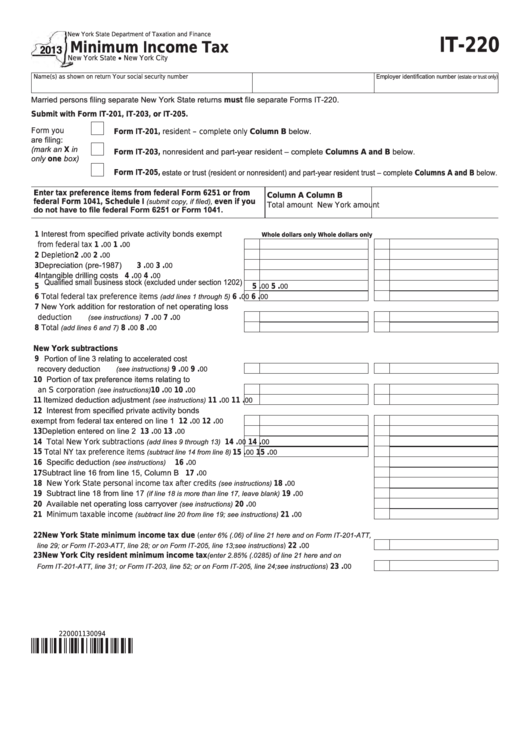

New York State Department of Taxation and Finance

IT-220

Minimum Income Tax

•

New York State

New York City

Name(s) as shown on return

Your social security number

Employer identification number

(estate or trust only)

Married persons filing separate New York State returns must file separate Forms IT-220.

Submit with Form IT-201, IT-203, or IT-205.

Form you

Form IT-201, resident – complete only Column B below.

are filing:

(mark an X in

Form IT-203, nonresident and part-year resident – complete Columns A and B below.

only one box)

Form IT-205, estate or trust (resident or nonresident) and part-year resident trust – complete Columns A and B below.

Enter tax preference items from federal Form 6251 or from

Column A

Column B

(submit copy, if filed),

federal Form 1041, Schedule I

even if you

Total amount

New York amount

do not have to file federal Form 6251 or Form 1041.

1 Interest from specified private activity bonds exempt

Whole dollars only

Whole dollars only

from federal tax .............................................................

00

00

.

.

1

1

2 Depletion ...........................................................................

00

00

.

.

2

2

3 Depreciation (pre-1987) ....................................................

00

00

.

.

3

3

4 Intangible drilling costs .....................................................

00

00

.

.

4

4

5 Qualified small business stock (excluded under section 1202)

00

00

.

.

5

5

6 Total federal tax preference items

....

(add lines 1 through 5)

00

00

.

.

6

6

7 New York addition for restoration of net operating loss

deduction

..............................................

(see instructions)

00

00

.

.

7

7

8 Total

.......................................................

00

00

(add lines 6 and 7)

.

.

8

8

New York subtractions

9 Portion of line 3 relating to accelerated cost

recovery deduction

................................

(see instructions)

00

00

.

.

9

9

10 Portion of tax preference items relating to

an S corporation

................................... 10

(see instructions)

00

00

.

.

10

11 Itemized deduction adjustment

................ 11

(see instructions)

00

00

.

.

11

12 Interest from specified private activity bonds

exempt from federal tax entered on line 1 ..................... 12

00

00

.

.

12

13 Depletion entered on line 2 ............................................... 13

00

00

.

.

13

14 Total New York subtractions

........... 14

(add lines 9 through 13)

00

00

.

.

14

15 Total NY tax preference items

..... 15

(subtract line 14 from line 8)

00

00

.

.

15

16 Specific deduction

................................................................................................ 16

(see instructions)

00

.

17 Subtract line 16 from line 15, Column B ....................................................................................... 17

00

.

18 New York State personal income tax after credits

............................................... 18

(see instructions)

00

.

19 Subtract line 18 from line 17

........................................... 19

(if line 18 is more than line 17, leave blank)

00

.

20 Available net operating loss carryover

................................................................. 20

(see instructions)

00

.

21 Minimum taxable income

............................................ 21

(subtract line 20 from line 19; see instructions)

00

.

(enter 6% (.06) of line 21 here and on Form IT-201-ATT,

22 New York State minimum income tax due

................................. 22

line 29; or Form IT-203-ATT, line 28; or on Form IT-205, line 13; see instructions)

00

.

(enter 2.85% (.0285) of line 21 here and on

23 New York City resident minimum income tax

.............. 23

Form IT-201-ATT, line 31; or Form IT-203, line 52; or on Form IT-205, line 24; see instructions)

00

.

220001130094

1

1