Clear All Pages

Clear This Page

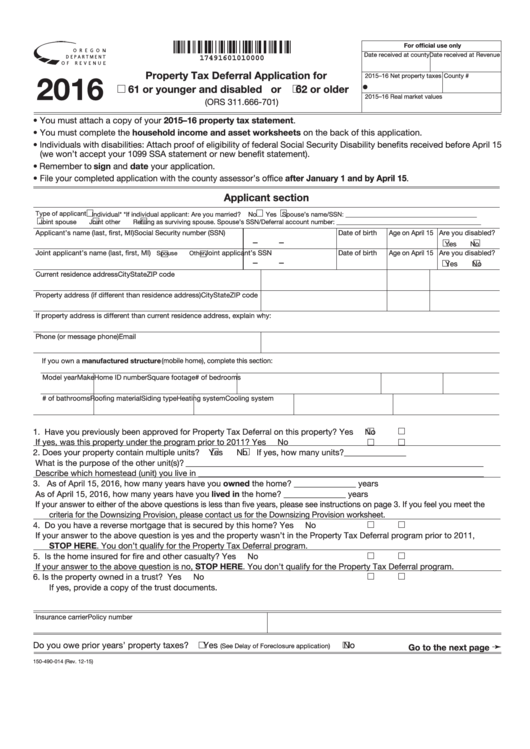

For official use only

Date received at county Date received at Revenue

17491601010000

Property Tax Deferral Application for

2016

2015–16 Net property taxes

County #

•

61 or younger and disabled or

62 or older

2015–16 Real market values

(ORS 311.666-701)

• You must attach a copy of your 2015–16 property tax statement.

• You must complete the household income and asset worksheets on the back of this application.

• Individuals with disabilities: Attach proof of eligibility of federal Social Security Disability benefits received before April 15

(we won’t accept your 1099 SSA statement or new benefit statement).

• Remember to sign and date your application.

• File your completed application with the county assessor’s office after January 1 and by April 15.

Applicant section

Type of applicant

Individual*

*If individual applicant: Are you married?

No

Yes Spouse’s name/SSN: ________________________________________

Joint spouse

Joint other

Refiling as surviving spouse. Spouse’s SSN/Deferral account number: ____________________________________________

Applicant’s name (last, first, MI)

Social Security number (SSN)

Date of birth

Age on April 15 Are you disabled?

–

–

Yes

No

Joint applicant’s name (last, first, MI)

Joint applicant’s SSN

Date of birth

Age on April 15 Are you disabled?

Spouse

Other

–

–

Yes

No

Current residence address

City

State

ZIP code

Property address (if different than residence address)

City

State

ZIP code

If property address is different than current residence address, explain why:

Phone (or message phone)

Email

If you own a manufactured structure (mobile home), complete this section:

Model year

Make

Home ID number

Square footage

# of bedrooms

# of bathrooms Roofing material

Siding type

Heating system

Cooling system

1.

Have you previously been approved for Property Tax Deferral on this property? .............

Yes

No

If yes, was this property under the program prior to 2011? ..............................................

Yes

No

2.

Does your property contain multiple units?

Yes

No

If yes, how many units?_______________

What is the purpose of the other unit(s)? ________________________________________________________________________

Describe which homestead (unit) you live in _____________________________________________________________________

As of April 15, 2016, how many years have you owned the home? _______________ years

3.

As of April 15, 2016, how many years have you lived in the home? _______________ years

If your answer to either of the above questions is less than five years, please see instructions on page 3. If you feel you meet the

criteria for the Downsizing Provision, please contact us for the Downsizing Provision worksheet.

4.

Do you have a reverse mortgage that is secured by this home? ......................................

Yes

No

If your answer to the above question is yes and the property wasn’t in the Property Tax Deferral program prior to 2011,

STOP HERE. You don’t qualify for the Property Tax Deferral program.

5.

Is the home insured for fire and other casualty? ...............................................................

Yes

No

If your answer to the above question is no, STOP HERE. You don’t qualify for the Property Tax Deferral program.

6.

Is the property owned in a trust? .......................................................................................

Yes

No

If yes, provide a copy of the trust documents.

Insurance carrier

Policy number

Do you owe prior years’ property taxes?

Yes

No

➛

(See Delay of Foreclosure application)

Go to the next page

150-490-014 (Rev. 12-15)

1

1 2

2 3

3