Form Nj-8879 - Nj E-File Signature Authorization - 2015

ADVERTISEMENT

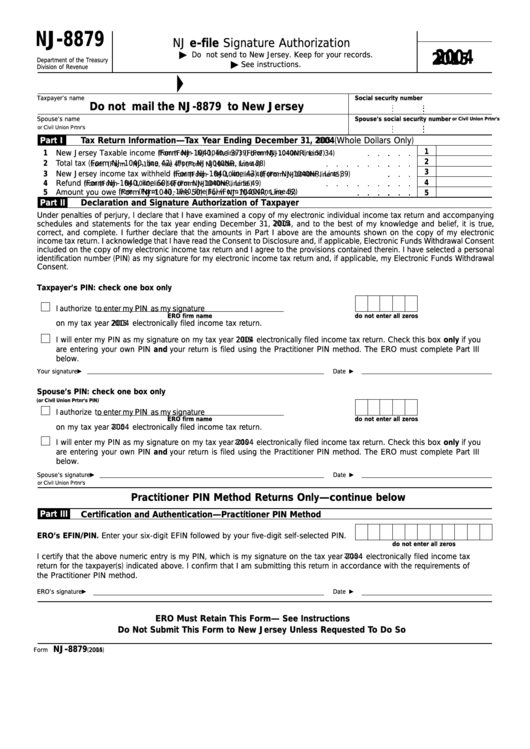

NJ-8879

NJ e-file Signature Authorization

2004

Do not send to New Jersey. Keep for your records.

2015

Department of the Treasury

See instructions.

Division of Revenue

Taxpayer’s name

Social security number

Do not mail the NJ-8879 to New Jersey

Spouse’s name

Spouse’s social security number

or Civil Union Prtnr's

or Civil Union Prtnr's

Part I

Tax Return Information—Tax Year Ending December 31, 2004 (Whole Dollars Only)

2015

1

1

New Jersey Taxable income (Form NJ-1040, line 37)

from (Form NJ-1040, line 39) (Form NJ1040nr, line 37)

(Form NJ-1040NR, Line 34)

2

2

Total tax (Form NJ-1040, line 42)

(Form NJ-1040NR, Line 38)

from (Form

NJ-1040, line 47) (Form NJ1040nr, line 44)

3

3

New Jersey income tax withheld (Form NJ-1040, line 43)

(Form NJ-1040NR, Line 39)

from (Form

NJ-1040, line 48) (Form NJ1040nr, line 45)

4

4

Refund (Form NJ-1040, line 60)

from (Form

NJ-1040, line 66) (Form NJ1040nr, line 56)

(Form NJ-1040NR, Line 49)

5

Amount you owe (Form NJ-1040, line 50)

from (Form

NJ-1040, line 56) (Form NJ1040nr, line 52)

(Form NJ-1040NR, Line 45)

5

Part II

Declaration and Signature Authorization of Taxpayer

Under penalties of perjury, I declare that I have examined a copy of my electronic individual income tax return and accompanying

2015

schedules and statements for the tax year ending December 31, 2004, and to the best of my knowledge and belief, it is true,

correct, and complete. I further declare that the amounts in Part I above are the amounts shown on the copy of my electronic

income tax return. I acknowledge that I have read the Consent to Disclosure and, if applicable, Electronic Funds Withdrawal Consent

included on the copy of my electronic income tax return and I agree to the provisions contained therein. I have selected a personal

identification number (PIN) as my signature for my electronic income tax return and, if applicable, my Electronic Funds Withdrawal

Consent.

Taxpayer’s PIN: check one box only

I authorize

to enter my PIN

as my signature

ERO firm name

do not enter all zeros

on my tax year 2004 electronically filed income tax return.

2015

I will enter my PIN as my signature on my tax year 2004 electronically filed income tax return. Check this box only if you

2015

are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III

below.

Your signature

Date

Spouse’s PIN: check one box only

(or Civil Union Prtnr's PIN)

I authorize

to enter my PIN

as my signature

ERO firm name

do not enter all zeros

on my tax year 2004 electronically filed income tax return.

2015

I will enter my PIN as my signature on my tax year 2004 electronically filed income tax return. Check this box only if you

2015

are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III

below.

Spouse’s signature

Date

or Civil Union Prtnr's

Practitioner PIN Method Returns Only—continue below

Part III

Certification and Authentication—Practitioner PIN Method

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature on the tax year 2004 electronically filed income tax

2015

return for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of

the Practitioner PIN method.

ERO’s signature

Date

ERO Must Retain This Form — See Instructions

Do Not Submit This Form to New Jersey Unless Requested To Do So

NJ-8879

2015

Form

(2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2