Fid-Ext - New Mexico Fiduciary Income Tax Extension Payment Voucher - 2014

ADVERTISEMENT

State of New Mexico Taxation and Revenue Department

2014 FID-EXT

Fiduciary Income Tax Extension Payment Voucher

Purpose of this form. Use this 2014 FID-EXT payment voucher to make an extension payment towards a 2014 fiduciary income tax

liability. An extention payment requires a federal automatic extension or a New Mexico extension; a payment towards a potential tax

liability with FID-EXT avoids accrual of interest. By obtaining an extension of time to file your return, penalty for failure to file and

pay is waived through the extension period, provided you file the return and pay the tax shown on the return by the extend-

ed due date. Interest accrues even if you obtain an extension of time to file and pay the return. Interest is assessed daily at the

quarterly rate established by the U.S. Internal Revenue Code on the amount of tax due. The Department posts annual and daily interest

rates for each quarter at Click Businesses and then under Popular Information, click Penalty and Interest

Rates.

If you expect to owe more tax when you file your 2014 return and you obtained an extension of time to file, make a payment using the

2014 FID-EXT payment voucher to avoid the accrual of interest on the principal tax due. Submit the payment voucher at the bottom with

your check or money order.

About the Application for Extension of Time to File.

Federal automatic extension filed. New Mexico recognizes and accepts an Internal Revenue Service (IRS) automatic extension

•

of time to file. If you obtain the federal automatic extension by filing Form 7004, Application for Automatic Extension of Time to File

Certain Business Income Tax, Information, and Other Returns for tax year 2014, you have the federal automatic extension period

allowed by the IRS to file your New Mexico return. You do not need to file Form RPD-41096, Application for Extension of Time to File.

Detach the voucher at the bottom and submit it to the Department with your extension payment.

New Mexico extension request filed. If you expect to file your federal return by the original due date or by the federal automatic

•

extension of time to file allowed by the IRS, but you need additional time to file your New Mexico return, you must obtain approval

through the state. To request approval, you must submit Form RPD-41096, Application for Extension of Time to File, on or before the

due date of the return or the extended due date of the return. You may submit RPD-41096 at the same time you submit your extension

payment. Detach the voucher at the bottom and submit it to the Department with your extension payment.

You may submit your payment with the payment voucher below or pay online at no charge by electronic check. You can pay online through

Taxpayer Access Point (TAP) at https://tap.state.nm.us. Under FOR BUSINESSES, click Make a Payment and then in Account Type,

select Fiduciary Income Tax. The electronic check authorizes the Department to debit your checking account in the amount and on

the date you specify. You may also use any of these credit cards—Visa, MasterCard, American Express, or Discover Card—for your

online payment. A convenience fee of 2.40% is applied for using a credit card. The State of New Mexico uses this fee, calculated on

the transaction amount, to pay charges from the credit card companies. To file a New Mexico application for extension of time to file and

pay, you must submit Form RPD-41096.

NOTE: When you provide a check as payment, you authorize the Department either to use information from your check to make a one-

time electronic fund transfer from your account, or to process the payment as a check transaction.

MAIL TO: New Mexico Taxation and Revenue Department

PO Box 25127

Santa Fe, NM 87504-5127

Please cut on the dotted line to detach the voucher and then submit it with your payment to the Department.

(CUT ON DOTTED LINE)

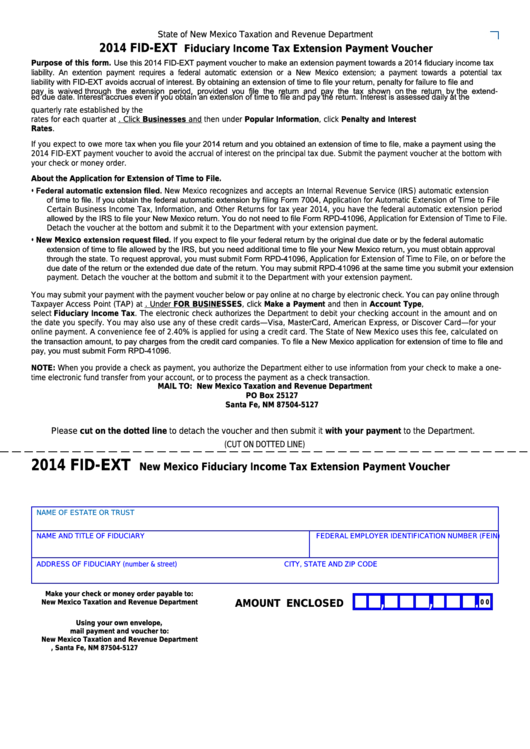

2014 FID-EXT

New Mexico Fiduciary Income Tax Extension Payment Voucher

NAME OF ESTATE OR TRUST

NAME AND TITLE OF FIDUCIARY

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

ADDRESS OF FIDUCIARY (number & street)

CITY, STATE AND ZIP CODE

, ,

Make your check or money order payable to:

,

,

.

AMOUNT ENCLOSED

New Mexico Taxation and Revenue Department

0 0

.

Using your own envelope,

mail payment and voucher to:

New Mexico Taxation and Revenue Department

P.O. Box 25127, Santa Fe, NM 87504-5127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2