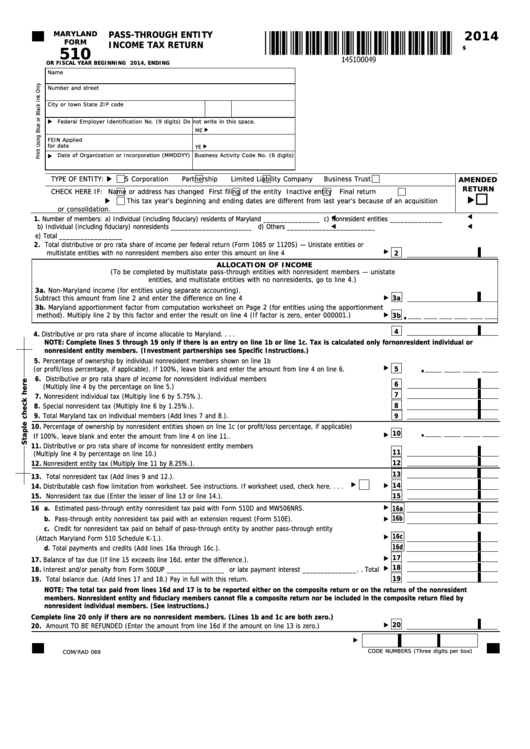

2014

PASS-THROUGH ENTITY

MARYLAND

FORM

INCOME TAX RETURN

510

$

OR FISCAL YEAR bEGINNING

2014, ENDING

Name

Number and street

City or town

State

ZIP code

Federal Employer Identification No . (9 digits)

Do not write in this space .

ME

FEIN Applied

for date

YE

Date of Organization or Incorporation (MMDDYY)

Business Activity Code No . (6 digits)

TYPE OF ENTITY: S Corporation

Partnership

Limited Liability Company

Business Trust

AMENDED

RETURN

CHECK HERE IF:

Name or address has changed

First filing of the entity

Inactive entity

Final return

This tax year’s beginning and ending dates are different from last year’s because of an acquisition

or consolidation .

1. Number of members:

a) Individual (including fiduciary) residents of Maryland ________________

c) Nonresident entities _______________

b) Individual (including fiduciary) nonresidents _______________________

d) Others _________________________

e) Total __________________

2. Total distributive or pro rata share of income per federal return (Form 1065 or 1120S) — Unistate entities or

multistate entities with no nonresident members also enter this amount on line 4 . . . . . . . . . . . . . . . . . . . . . . .

2

ALLOCATION OF INCOME

(To be completed by multistate pass-through entities with nonresident members — unistate

entities, and multistate entities with no nonresidents, go to line 4 .)

3a. Non-Maryland income (for entities using separate accounting) .

3a

Subtract this amount from line 2 and enter the difference on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b. Maryland apportionment factor from computation worksheet on Page 2 (for entities using the apportionment

.

method) . Multiply line 2 by this factor and enter the result on line 4 (If factor is zero, enter 000001 .) . . . .

3b

4

4. Distributive or pro rata share of income allocable to Maryland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: Complete lines 5 through 19 only if there is an entry on line 1b or line 1c. Tax is calculated only for nonresident individual or

nonresident entity members. (Investment partnerships see Specific Instructions.)

5. Percentage of ownership by individual nonresident members shown on line 1b

.

(or profit/loss percentage, if applicable) . If 100%, leave blank and enter the amount from line 4 on line 6 . . . . . . .

5

6. Distributive or pro rata share of income for nonresident individual members

6

(Multiply line 4 by the percentage on line 5 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7. Nonresident individual tax (Multiply line 6 by 5 .75% .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Special nonresident tax (Multiply line 6 by 1 .25% .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. Total Maryland tax on individual members (Add lines 7 and 8 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Percentage of ownership by nonresident entities shown on line 1c (or profit/loss percentage, if applicable)

.

10

If 100%, leave blank and enter the amount from line 4 on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Distributive or pro rata share of income for nonresident entity members

11

(Multiply line 4 by percentage on line 10 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12. Nonresident entity tax (Multiply line 11 by 8 .25% .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13. Total nonresident tax (Add lines 9 and 12 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14. Distributable cash flow limitation from worksheet . See instructions . If worksheet used, check here . . . . . . . . . . . . .

15. Nonresident tax due (Enter the lesser of line 13 or line 14 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 a. Estimated pass-through entity nonresident tax paid with Form 510D and MW506NRS . . . . . . . . . . . . . . . . . . . .

16a

16b

b. Pass-through entity nonresident tax paid with an extension request (Form 510E) . . . . . . . . . . . . . . . . . . . . . . .

c. Credit for nonresident tax paid on behalf of pass-through entity by another pass-through entity

16c

(Attach Maryland Form 510 Schedule K-1 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16d

d. Total payments and credits (Add lines 16a through 16c .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17. Balance of tax due (If line 15 exceeds line 16d, enter the difference .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

18. Interest and/or penalty from Form 500UP ________________ or late payment interest _______________ . . Total

19

19. Total balance due . (Add lines 17 and 18 .) Pay in full with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: The total tax paid from lines 16d and 17 is to be reported either on the composite return or on the returns of the nonresident

members. Nonresident entity and fiduciary members cannot file a composite return nor be included in the composite return filed by

nonresident individual members. (See instructions.)

Complete line 20 only if there are no nonresident members. (Lines 1b and 1c are both zero.)

20

20. Amount TO BE REFUNDED (Enter the amount from line 16d if the amount on line 13 is zero .) . . . . . . . . . . . . . . . .

CODE NUMBERS (Three digits per box)

COM/RAD 069

1

1 2

2 3

3 4

4 5

5 6

6