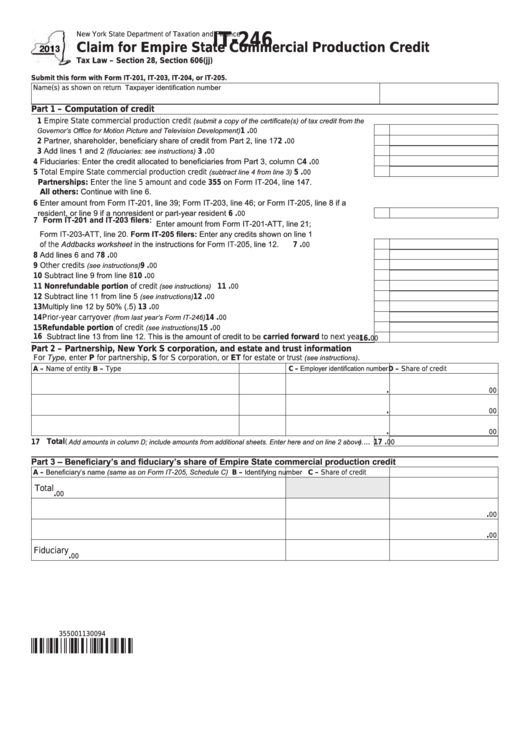

New York State Department of Taxation and Finance

IT-246

Claim for Empire State Commercial Production Credit

Tax Law – Section 28, Section 606(jj)

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Taxpayer identification number

Part 1 – Computation of credit

1 Empire State commercial production credit

(submit a copy of the certificate(s) of tax credit from the

.....................................................

Governor’s Office for Motion Picture and Television Development)

00

.

1

2 Partner, shareholder, beneficiary share of credit from Part 2, line 17 ..........................................

00

.

2

3 Add lines 1 and 2

................................................................................

(fiduciaries: see instructions)

00

.

3

4 Fiduciaries: Enter the credit allocated to beneficiaries from Part 3, column C .............................

00

.

4

5 Total Empire State commercial production credit

..................................

(subtract line 4 from line 3)

00

.

5

Partnerships: Enter the line 5 amount and code 355 on Form IT-204, line 147.

All others: Continue with line 6.

6 Enter amount from Form IT-201, line 39; Form IT-203, line 46; or Form IT-205, line 8 if a

resident, or line 9 if a nonresident or part-year resident ..........................................................

00

.

6

7 Form IT-201 and IT-203 filers: Enter amount from Form IT-201-ATT, line 21;

Form IT-203-ATT, line 20. Form IT-205 filers: Enter any credits shown on line 1

of the Addbacks worksheet in the instructions for Form IT-205, line 12. ...................................

00

.

7

8 Add lines 6 and 7..........................................................................................................................

00

.

8

9 Other credits

.......................................................................................................

(see instructions)

00

.

9

10 Subtract line 9 from line 8............................................................................................................. 10

00

.

11 Nonrefundable portion of credit

.............................................................................. 11

(see instructions)

00

.

12 Subtract line 11 from line 5

................................................................................. 12

(see instructions)

00

.

13 Multiply line 12 by 50% (.5) ......................................................................................................... 13

00

.

14 Prior-year carryover

.......................................................................... 14

(from last year’s Form IT-246)

00

.

15 Refundable portion of credit

............................................................................ 15

00

(see instructions)

.

16 Subtract line 13 from line 12. This is the amount of credit to be carried forward to next year ..... 16

00

.

Part 2 – Partnership, New York S corporation, and estate and trust information

For Type, enter P for partnership, S for S corporation, or ET for estate or trust

(see instructions)

.

A – Name of entity

B – Type

C – Employer identification number

D – Share of credit

00

.

00

.

00

.

... 17

(Add amounts in column D; include amounts from additional sheets. Enter here and on line 2 above.)

00

.

17 Total

Part 3 – Beneficiary’s and fiduciary’s share of Empire State commercial production credit

A – Beneficiary’s name (same as on Form IT-205, Schedule C)

B – Identifying number

C – Share of credit

Total

00

.

00

.

00

.

Fiduciary

00

.

355001130094

1

1