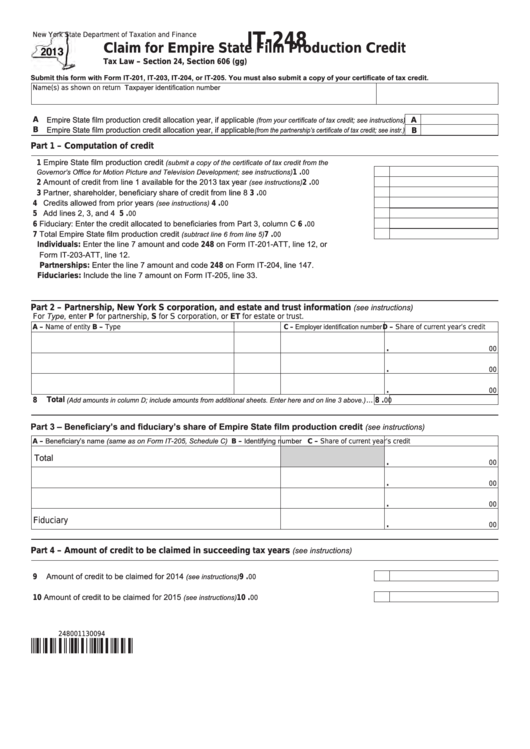

IT-248

New York State Department of Taxation and Finance

Claim for Empire State Film Production Credit

Tax Law – Section 24, Section 606 (gg)

Submit this form with Form IT-201, IT-203, IT-204, or IT-205. You must also submit a copy of your certificate of tax credit.

Taxpayer identification number

Name(s) as shown on return

A Empire State film production credit allocation year, if applicable

(from your certificate of tax credit; see instructions)

A

B Empire State film production credit allocation year, if applicable

(from the partnership’s certificate of tax credit; see instr.)

B

Part 1 – Computation of credit

1 Empire State film production credit

(submit a copy of the certificate of tax credit from the

Governor’s Office for Motion Picture and Television Development; see instructions)

.

............................

1

00

2 Amount of credit from line 1 available for the 2013 tax year

(see instructions)

.

..............................

2

00

3 Partner, shareholder, beneficiary share of credit from line 8 .......................................................

.

3

00

4 Credits allowed from prior years

(see instructions)

.

........................................................................

4

00

5 Add lines 2, 3, and 4 ....................................................................................................................

.

5

00

6 Fiduciary: Enter the credit allocated to beneficiaries from Part 3, column C ...............................

.

6

00

7 Total Empire State film production credit

(subtract line 6 from line 5)

.

..............................................

7

00

Individuals: Enter the line 7 amount and code 248 on Form IT-201-ATT, line 12, or

Form IT-203-ATT, line 12.

Partnerships: Enter the line 7 amount and code 248 on Form IT-204, line 147.

Fiduciaries: Include the line 7 amount on Form IT-205, line 33.

(see instructions)

Part 2 – Partnership, New York S corporation, and estate and trust information

For Type, enter P for partnership, S for S corporation, or ET for estate or trust.

C – Employer identification number

A – Name of entity

B – Type

D – Share of current year’s credit

.

00

.

00

.

00

(Add amounts in column D; include amounts from additional sheets. Enter here and on line 3 above.)

.

8 Total

...

8

00

Part 3 – Beneficiary’s and fiduciary’s share of Empire State film production credit

(see instructions)

A – Beneficiary’s name (same as on Form IT‑205, Schedule C)

B – Identifying number

C – Share of current year’s credit

Total

.

00

.

00

.

00

Fiduciary

.

00

(see instructions)

Part 4 – Amount of credit to be claimed in succeeding tax years

9 Amount of credit to be claimed for 2014

(see instructions)

.

............................................................

9

00

10 Amount of credit to be claimed for 2015

(see instructions)

.

............................................................ 10

00

248001130094

1

1