Form VA-5 Employer’s Return of Virginia Income Tax Withheld

Electronic Filing Mandate: All employers must file all returns and make

Returns and payments must be submitted electronically on or before the due

all payments electronically using eForms, Business iFile, Web Upload or

date to be considered filed and paid on time. For additional information, please

ACH Credit. See for information on these electronic

refer to the Department’s Electronic Payment Guide at .

filing options.

If your bank does not honor any payment to the Department, the Department

If you are unable to file and pay electronically, you may request a temporary

may impose a penalty of $35 as authorized by Va. Code § 2.2-614.1. This

waiver. A waiver form is available for download on the Department’s website.

penalty is in addition to other penalties such as for late payment of a tax.

The request must provide your business name, Virginia tax account number,

Change of Ownership: A new employer or location can be registered online

contact person, phone number, mailing address, the reason for the request,

through iReg or by completing Form R-1, Business Registration Application.

and the date when you will be able to file and pay electronically. Fax your

Visit to use iReg or download Form R-1. Forms are

request to (804) 367-3015.

also available by calling the Department’s Forms Request Unit at (804)

General: An employer who pays wages to one or more employees is required

440-2541.

to deduct and withhold state income tax from those wages. Virginia law

Change of Address/Out-of-Business: For a change of business name or

substantially conforms to the federal definition of “wages.” Therefore, Virginia

address or to notify the Department that you are no longer liable for Virginia

withholding is generally required on any payment for which federal withholding

Employer Income Tax Withholding, use Business iFile at

is required. Exceptions include, but are not limited to, amounts paid pursuant

gov.

to individual retirement accounts and simplified employee pension plans as

Questions: If you have any questions about this return, use Live Chat on the

defined in §§ 7701(a)(37) and 408(c) of the Internal Revenue Code.

Department’s website, call (804) 367-8037 or write the Virginia Department

Filing and Payment Procedure: An employer’s filing status is determined by

of Taxation, PO Box 1115, Richmond, Virginia 23218-1115.

the average amount of income tax withheld each month. When registering a

Preparation of Return

business, an employer is asked to estimate this figure so that the Department

can assign a filing status. Based on that information, the Department assigns

Line 1: Enter the amount of income tax withholding liability for the period

a quarterly, monthly, semi-weekly, or seasonal filing status. In addition, all

for which the return is being filed.

employers must file an annual summary, Form VA-6. Employers are not

Line 2: Enter the overpayment or underpayment from a prior period and

responsible for monitoring their monthly tax liabilities to see if a status change

attach a detailed explanation to the return. Please indicate an

is needed. The Department reviews each account annually and makes any

underpayment as a negative figure with brackets around the amount.

necessary changes. Notices of change in filing status are usually mailed

Line 3: Subtract overpayment (Line 2) from Line 1 or add underpayment

during December of each year and become effective on January 1.

(Line 2) to Line 1 and enter the amount. (Line 15 Line 2 = Line 3).

• Quarterly Filing: If an employer’s average monthly withholding tax

Line 4: Enter penalty, if applicable. If you file the return and/or pay the tax

liability is less than $100, the account will be assigned a quarterly filing

after the due date, a penalty is assessed. The penalty is 6% of the

status. Form VA-5, with full payment for the tax, or your EFT payment

tax due for each month or fraction of a month, not to exceed 30%.

is due on the last day of the month following the close of the quarter.

In no case will the penalty be less than $10, even if no tax is due.

A return or EFT zero transaction payment must be filed for each

quarter even if there is no tax due.

Line 5: Enter interest, if applicable. Interest on any tax due will be added

• Monthly Filing: If the average monthly withholding tax liability is at least

at the daily interest rate established in accordance with Va. Code §

58.1-15 from the date the unpaid tax (or unpaid balance) became

$100, but less than $1,000, a monthly filing status will be assigned.

due until it is paid. The interest rate is 2% over the underpayment

File Form VA-5 or make your EFT payment by the 25th day of the

rate established by Section 6621 of the Internal Revenue Code.

following month. A return or EFT zero transaction payment must

be filed for each month, even if there is no tax due.

Line 6: Enter the total of Lines 3, 4 and 5.

• Seasonal Filing: Seasonal filers, those employers who have employees

Declaration and Signature: Be sure to sign, date and enter your phone

only during certain months of the year, are required to file returns for

number on the reverse side of the return in the space indicated.

the months designated at the time they register for an account,

Make checks payable to VA Department of Taxation. Mail return and payment

even if there is no tax due. Seasonal returns are filed on Form VA-5

to Virginia Department of Taxation, PO Box 27264, Richmond, Virginia

and are due at the normal monthly filing dates.

23261-7264.

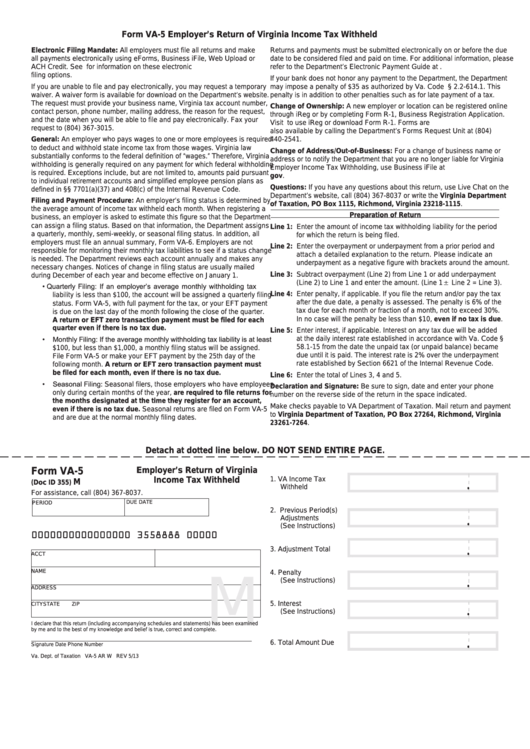

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form VA-5

Employer’s Return of Virginia

Income Tax Withheld

1. VA Income Tax

M

(Doc ID 355)

.

Withheld

For assistance, call (804) 367-8037.

DUE DATE

PERIOD

2. Previous Period(s)

Adjustments

.

(See Instructions)

0000000000000000 3558888 00000

3. Adjustment Total

.

ACCT NO.

FEIN

NAME

4. Penalty

M

(See Instructions)

.

ADDRESS

5. Interest

CITY

STATE

ZIP

.

(See Instructions)

I declare that this return (including accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is true, correct and complete.

6. Total Amount Due

.

Signature

Date

Phone Number

Va. Dept. of Taxation VA-5 AR W REV 5/13

1

1