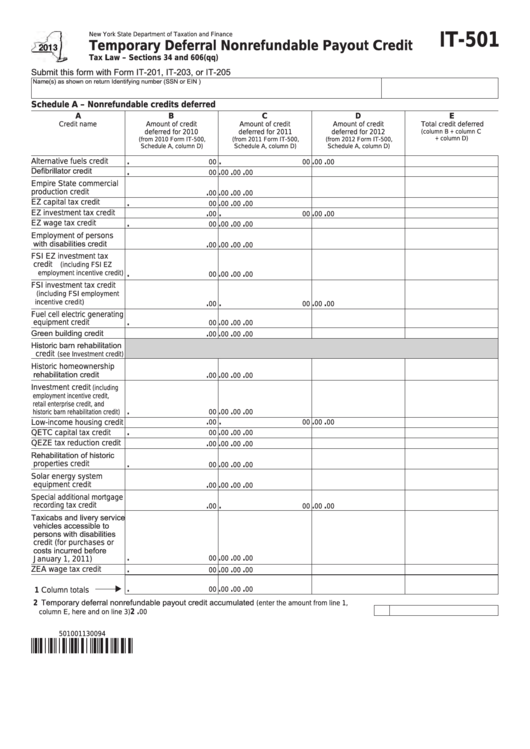

New York State Department of Taxation and Finance

IT-501

Temporary Deferral Nonrefundable Payout Credit

Tax Law – Sections 34 and 606(qq)

Submit this form with Form IT-201, IT-203, or IT-205

Name(s) as shown on return

Identifying number (SSN or EIN )

Schedule A – Nonrefundable credits deferred

A

B

C

D

E

Credit name

Amount of credit

Amount of credit

Amount of credit

Total credit deferred

(column B + column C

deferred for 2010

deferred for 2011

deferred for 2012

+ column D)

(from 2010 Form IT-500,

(from 2011 Form IT-500,

(from 2012 Form IT-500,

Schedule A, column D)

Schedule A, column D)

Schedule A, column D)

Alternative fuels credit

.

.

.

.

00

00

00

00

Defibrillator credit

.

.

.

.

00

00

00

00

Empire State commercial

production credit

.

.

.

.

00

00

00

00

EZ capital tax credit

.

.

.

.

00

00

00

00

EZ investment tax credit

.

.

.

.

00

00

00

00

EZ wage tax credit

.

.

.

.

00

00

00

00

Employment of persons

with disabilities credit

.

.

.

.

00

00

00

00

FSI EZ investment tax

credit

(including FSI EZ

employment incentive credit)

.

.

.

.

00

00

00

00

FSI investment tax credit

(including FSI employment

incentive credit)

.

.

.

.

00

00

00

00

Fuel cell electric generating

.

.

.

.

equipment credit

00

00

00

00

Green building credit

.

.

.

.

00

00

00

00

Historic barn rehabilitation

credit

(see Investment credit)

Historic homeownership

rehabilitation credit

.

.

.

.

00

00

00

00

Investment credit

(including

employment incentive credit,

retail enterprise credit, and

.

.

.

.

00

00

00

00

historic barn rehabilitation credit)

.

.

.

.

Low-income housing credit

00

00

00

00

.

.

.

.

QETC capital tax credit

00

00

00

00

QEZE tax reduction credit

.

.

.

.

00

00

00

00

Rehabilitation of historic

properties credit

.

.

.

.

00

00

00

00

Solar energy system

equipment credit

.

.

.

.

00

00

00

00

Special additional mortgage

recording tax credit

.

.

.

.

00

00

00

00

Taxicabs and livery service

vehicles accessible to

persons with disabilities

credit (for purchases or

costs incurred before

.

.

.

.

00

00

00

00

January 1, 2011)

ZEA wage tax credit

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

1 Column totals

2 Temporary deferral nonrefundable payout credit accumulated

(enter the amount from line 1,

.

.........................................................................................................

2

column E, here and on line 3)

00

501001130094

1

1 2

2