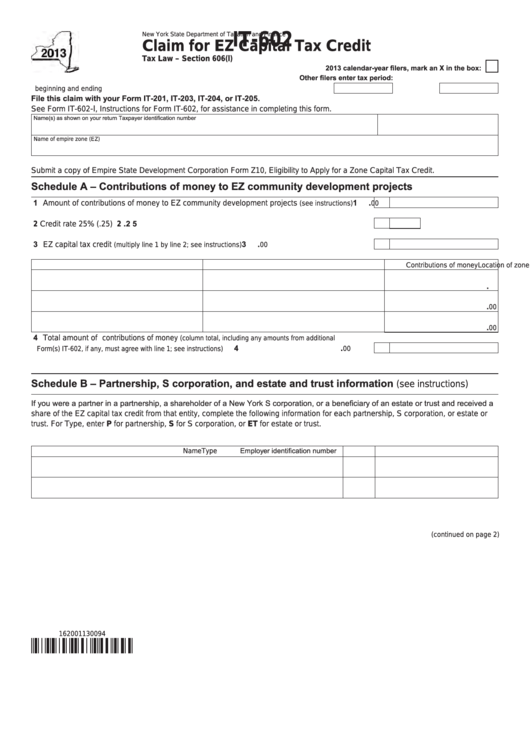

New York State Department of Taxation and Finance

IT-602

Claim for EZ Capital Tax Credit

Tax Law – Section 606(l)

2013 calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

File this claim with your Form IT-201, IT-203, IT-204, or IT-205.

-I

See Form IT-602

, Instructions for Form IT-602, for assistance in completing this form.

Name(s) as shown on your return

Taxpayer identification number

Name of empire zone (EZ)

Submit a copy of Empire State Development Corporation Form Z10, Eligibility to Apply for a Zone Capital Tax Credit.

Schedule A – Contributions of money to EZ community development projects

.

1 Amount of contributions of money to EZ community development projects

1

.......

(see instructions)

00

.

2 5

2 Credit rate 25% (.25) ....................................................................................................................

2

.

3 EZ capital tax credit

3

..........................................................

(multiply line 1 by line 2; see instructions)

00

Name of community development project

Location of zone

Contributions of money

.

00

.

00

.

00

4 Total amount of contributions of money

(column total, including any amounts from additional

.

4

...............................................................

Form(s) IT-602, if any, must agree with line 1; see instructions)

00

Schedule B – Partnership, S corporation, and estate and trust information

(see instructions)

If you were a partner in a partnership, a shareholder of a New York S corporation, or a beneficiary of an estate or trust and received a

share of the EZ capital tax credit from that entity, complete the following information for each partnership, S corporation, or estate or

trust. For Type, enter P for partnership, S for S corporation, or ET for estate or trust.

Employer identification number

Name

Type

(continued on page 2)

162001130094

1

1 2

2 3

3