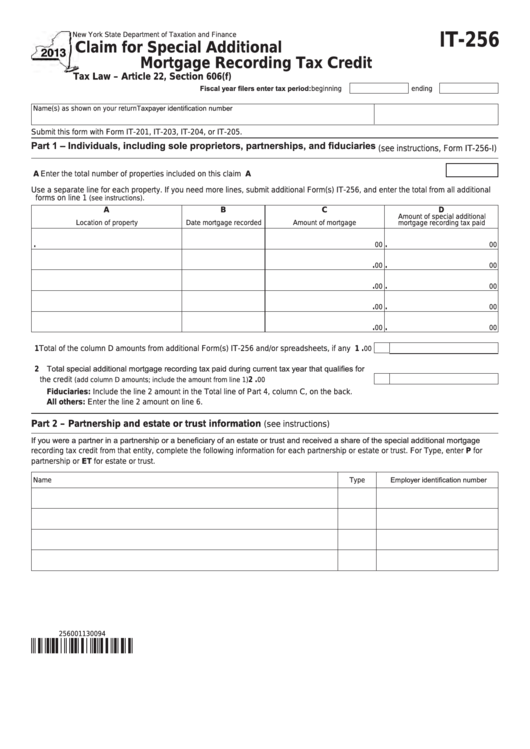

New York State Department of Taxation and Finance

IT-256

Claim for Special Additional

Mortgage Recording Tax Credit

Tax Law – Article 22, Section 606(f)

Fiscal year filers enter tax period: beginning

ending

Name(s) as shown on your return

Taxpayer identification number

Submit this form with Form IT‑201, IT‑203, IT‑204, or IT‑205.

Part 1 – Individuals, including sole proprietors, partnerships, and fiduciaries

(see instructions, Form IT-256-I)

A Enter the total number of properties included on this claim .................................................................................... A

Use a separate line for each property. If you need more lines, submit additional Form(s) IT‑256, and enter the total from all additional

forms on line 1

.

(see instructions)

A

B

C

D

Amount of special additional

Location of property

Date mortgage recorded

Amount of mortgage

mortgage recording tax paid

00

00

.

.

00

00

.

.

00

00

.

.

00

00

.

.

00

00

.

.

1 Total of the column D amounts from additional Form(s) IT‑256 and/or spreadsheets, if any .......

00

.

1

2 Total special additional mortgage recording tax paid during current tax year that qualifies for

the credit

..................................................

00

.

2

(add column D amounts; include the amount from line 1)

Fiduciaries: Include the line 2 amount in the Total line of Part 4, column C, on the back.

All others: Enter the line 2 amount on line 6.

Part 2 – Partnership and estate or trust information

(see instructions)

If you were a partner in a partnership or a beneficiary of an estate or trust and received a share of the special additional mortgage

recording tax credit from that entity, complete the following information for each partnership or estate or trust. For Type, enter P for

partnership or ET for estate or trust.

Name

Type

Employer identification number

256001130094

1

1 2

2