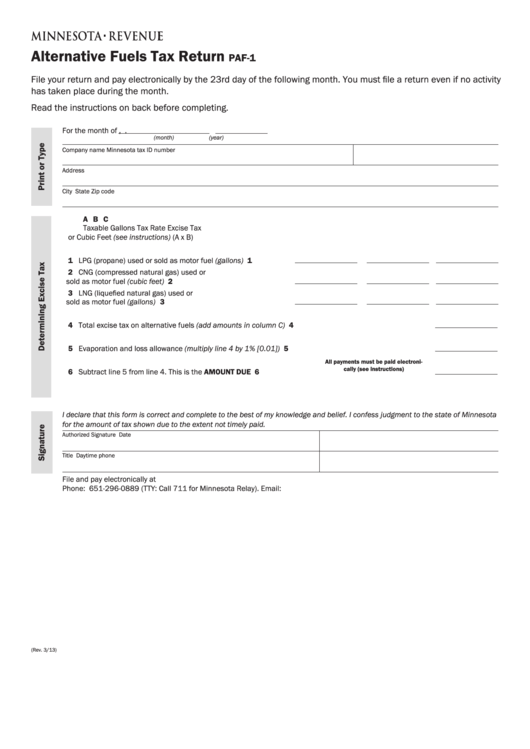

Alternative Fuels Tax Return

PAF-1

File your return and pay electronically by the 23rd day of the following month. You must file a return even if no activity

has taken place during the month.

Read the instructions on back before completing.

For the month of

,

.

(month)

(year)

Company name

Minnesota tax ID number

Address

City

State

Zip code

A

B

C

Taxable Gallons

Tax Rate

Excise Tax

or Cubic Feet

(see instructions)

(A x B)

1 LPG (propane) used or sold as motor fuel (gallons) . . . . . . . . . . 1

2 CNG (compressed natural gas) used or

sold as motor fuel (cubic feet) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 LNG (liquefied natural gas) used or

sold as motor fuel (gallons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total excise tax on alternative fuels (add amounts in column C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Evaporation and loss allowance (multiply line 4 by 1% [0.01]) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

All payments must be paid electroni-

cally (see instructions)

6 Subtract line 5 from line 4. This is the AMOUNT DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

I declare that this form is correct and complete to the best of my knowledge and belief. I confess judgment to the state of Minnesota

for the amount of tax shown due to the extent not timely paid.

Authorized Signature

Date

Title

Daytime phone

File and pay electronically at Keep a signed copy of this return with your tax records.

Phone: 651-296-0889 (TTY: Call 711 for Minnesota Relay). Email: petroleum.tax@state.mn.us

(Rev. 3/13)

1

1 2

2