Reset Form

Print Form

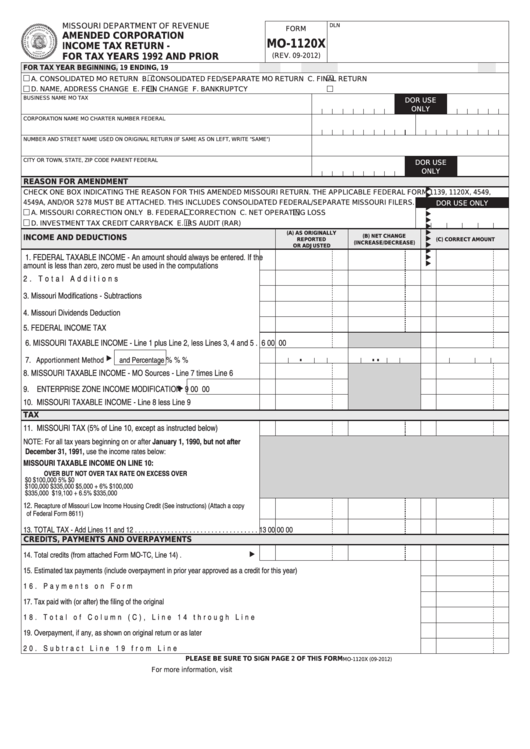

MISSOURI DEPARTMENT OF REVENUE

DLN

FORM

AMENDED CORPORATION

MO-1120X

INCOME TAX RETURN -

FOR TAX YEARS 1992 AND PRIOR

(REV. 09-2012)

FOR TAX YEAR BEGINNING

, 19

ENDING

, 19

A. CONSOLIDATED MO RETURN

B. CONSOLIDATED FED/SEPARATE MO RETURN

C. FINAL RETURN

D. NAME, ADDRESS CHANGE

E. FEIN CHANGE

F. BANKRUPTCY

BUSINESS NAME

MO TAX I.D. NUMBER

DOR USE

ONLY

CORPORATION NAME

MO CHARTER NUMBER

FEDERAL I.D. NUMBER

NUMBER AND STREET

NAME USED ON ORIGINAL RETURN (IF SAME AS ON LEFT, WRITE “SAME”)

CITY OR TOWN, STATE, ZIP CODE

PARENT FEDERAL I.D. NUMBER

DOR USE

ONLY

REASON FOR AMENDMENT

CHECK ONE BOX INDICATING THE REASON FOR THIS AMENDED MISSOURI RETURN. THE APPLICABLE FEDERAL FORM 1139, 1120X, 4549,

4549A, AND/OR 5278 MUST BE ATTACHED. THIS INCLUDES CONSOLIDATED FEDERAL/SEPARATE MISSOURI FILERS.

DOR USE ONLY

A. MISSOURI CORRECTION ONLY

B. FEDERAL CORRECTION

C. NET OPERATING LOSS

D. INVESTMENT TAX CREDIT CARRYBACK

E. IRS AUDIT (RAR)

(A) AS ORIGINALLY

(B) NET CHANGE

INCOME AND DEDUCTIONS

REPORTED

(C) CORRECT AMOUNT

(INCREASE/DECREASE)

OR ADJUSTED

1. FEDERAL TAXABLE INCOME - An amount should always be entered. If the

amount is less than zero, zero must be used in the computations . . . . . . . . . . . .

1

00

00

00

2. Total Additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

00

00

3. Missouri Modifications - Subtractions . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

00

00

4. Missouri Dividends Deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

00

00

5. FEDERAL INCOME TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

00

6. MISSOURI TAXABLE INCOME - Line 1 plus Line 2, less Lines 3, 4 and 5 . 6

00

00

.

.

.

7.

Apportionment Method

and Percentage

. . . . . . . .

7

%

%

%

8. MISSOURI TAXABLE INCOME - MO Sources - Line 7 times Line 6 . . . . .

8

00

00

9. ENTERPRISE ZONE INCOME MODIFICATION

9

00

00

10. MISSOURI TAXABLE INCOME - Line 8 less Line 9 . . . . . . . . . . . . . . . . 10

00

00

TAX

11. MISSOURI TAX (5% of Line 10, except as instructed below) . . . . . . . . . . 11

00

00

00

NOTE: For all tax years beginning on or after January 1, 1990, but not after

December 31, 1991, use the income rates below:

MISSOURI TAXABLE INCOME ON LINE 10:

OVER

BUT NOT OVER

TAX RATE

ON EXCESS OVER

$0

$100,000

5%

$0

$100,000

$335,000

$5,000 + 6%

$100,000

$335,000

$19,100 + 6.5%

$335,000

12.

Recapture of Missouri Low Income Housing Credit (See instructions) (Attach a copy

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

00

00

of Federal Form 8611)

13. TOTAL TAX - Add Lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

00

00

CREDITS, PAYMENTS AND OVERPAYMENTS

14. Total credits (from attached Form MO-TC, Line 14) . . . . . . . . . . . . . . . . . .

14

00

00

00

15. Estimated tax payments (include overpayment in prior year approved as a credit for this year) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

16. Payments on Form MO-60. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

17. Tax paid with (or after) the filing of the original return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

18. Total of Column (C), Line 14 through Line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

19. Overpayment, if any, as shown on original return or as later adjusted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

20. Subtract Line 19 from Line 18. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

PLEASE BE SURE TO SIGN PAGE 2 OF THIS FORM

MO-1120X (09-2012)

For more information, visit

1

1 2

2