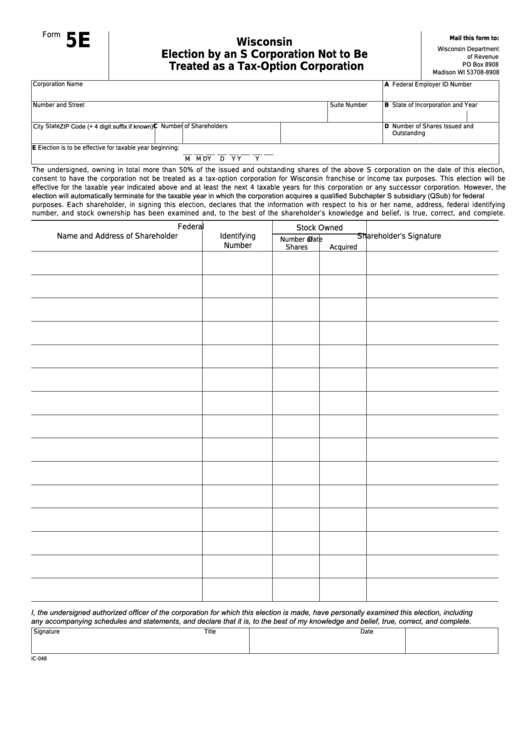

Form 5e - Wisconsin Election By An S Corporation Not To Be Treated As A Tax-Option Corporation

ADVERTISEMENT

Form

5E

Mail this form to:

Wisconsin

Wisconsin Department

Election by an S Corporation Not to Be

of Revenue

Treated as a Tax-Option Corporation

PO Box 8908

Madison WI 53708-8908

Corporation Name

A Federal Employer ID Number

Number and Street

Suite Number

B State of Incorporation

and

Year

ZIP Code (+ 4 digit suffix if known) C Number of Shareholders

State

D Number of Shares Issued and

City

Outstanding

E Election is to be effective for taxable year beginning:

M

M

D

D

Y

Y

Y

Y

The undersigned, owning in total more than 50% of the issued and outstanding shares of the above S corporation on the date of this election,

consent to have the corporation not be treated as a tax-option corporation for Wisconsin franchise or income tax purposes. This election will be

effective for the taxable year indicated above and at least the next 4 taxable years for this corporation or any successor corporation. However, the

election will automatically terminate for the taxable year in which the corporation acquires a qualified Subchapter S subsidiary (QSub) for federal

purposes. Each shareholder, in signing this election, declares that the information with respect to his or her name, address, federal identifying

number, and stock ownership has been examined and, to the best of the shareholder’s knowledge and belief, is true, correct, and complete.

Federal

Stock Owned

Name and Address of Shareholder

Identifying

Shareholder’s Signature

Number of

Date

Number

Shares

Acquired

I, the undersigned authorized officer of the corporation for which this election is made, have personally examined this election, including

any accompanying schedules and statements, and declare that it is, to the best of my knowledge and belief, true, correct, and complete.

Signature

Title

Date

IC-048

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2