Clear Form

FORM

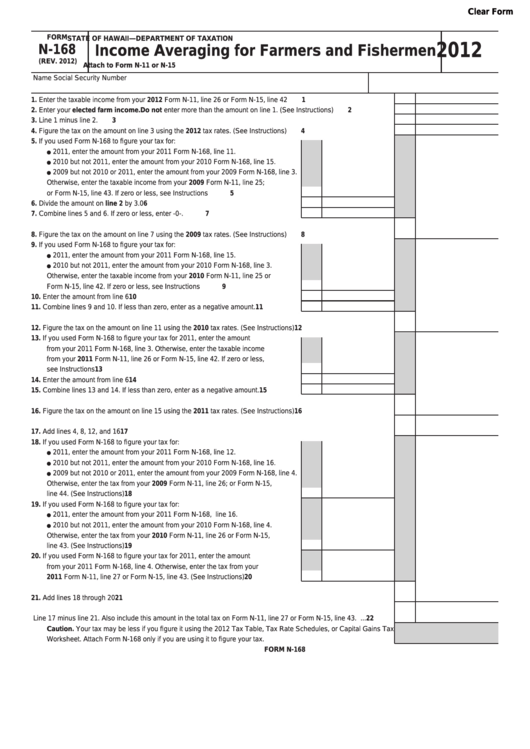

STATE OF HAWAII—DEPARTMENT OF TAXATION

2012

N-168

Income Averaging for Farmers and Fishermen

(REV. 2012)

Attach to Form N-11 or N-15

Name

Social Security Number

1.

Enter the taxable income from your 2012 Form N-11, line 26 or Form N-15, line 42 ....................................................

1

2.

Enter your elected farm income. Do not enter more than the amount on line 1. (See Instructions) ..........................

2

3.

Line 1 minus line 2. .........................................................................................................................................................

3

4.

Figure the tax on the amount on line 3 using the 2012 tax rates. (See Instructions) ....................................................

4

5.

If you used Form N-168 to figure your tax for:

•

2011, enter the amount from your 2011 Form N-168, line 11.

•

2010 but not 2011, enter the amount from your 2010 Form N-168, line 15.

•

2009 but not 2010 or 2011, enter the amount from your 2009 Form N-168, line 3.

Otherwise, enter the taxable income from your 2009 Form N-11, line 25;

or Form N-15, line 43. If zero or less, see Instructions ...........................................

5

6.

Divide the amount on line 2 by 3.0 ........................................................................

6

7.

Combine lines 5 and 6. If zero or less, enter -0-. ....................................................

7

8.

Figure the tax on the amount on line 7 using the 2009 tax rates. (See Instructions) ....................................................

8

9.

If you used Form N-168 to figure your tax for:

•

2011, enter the amount from your 2011 Form N-168, line 15.

•

2010 but not 2011, enter the amount from your 2010 Form N-168, line 3.

Otherwise, enter the taxable income from your 2010 Form N-11, line 25 or

Form N-15, line 42. If zero or less, see Instructions ...............................................

9

10. Enter the amount from line 6 ..................................................................................

10

11. Combine lines 9 and 10. If less than zero, enter as a negative amount. ................

11

12. Figure the tax on the amount on line 11 using the 2010 tax rates. (See Instructions) ..................................................

12

13. If you used Form N-168 to figure your tax for 2011, enter the amount

from your 2011 Form N-168, line 3. Otherwise, enter the taxable income

from your 2011 Form N-11, line 26 or Form N-15, line 42. If zero or less,

see Instructions .......................................................................................................

13

14. Enter the amount from line 6 ..................................................................................

14

15. Combine lines 13 and 14. If less than zero, enter as a negative amount...............

15

16. Figure the tax on the amount on line 15 using the 2011 tax rates. (See Instructions) ..................................................

16

17. Add lines 4, 8, 12, and 16 ...............................................................................................................................................

17

18. If you used Form N-168 to figure your tax for:

•

2011, enter the amount from your 2011 Form N-168, line 12.

•

2010 but not 2011, enter the amount from your 2010 Form N-168, line 16.

•

2009 but not 2010 or 2011, enter the amount from your 2009 Form N-168, line 4.

Otherwise, enter the tax from your 2009 Form N-11, line 26; or Form N-15,

line 44. (See Instructions) .......................................................................................

18

19. If you used Form N-168 to figure your tax for:

•

2011, enter the amount from your 2011 Form N-168, line 16.

•

2010 but not 2011, enter the amount from your 2010 Form N-168, line 4.

Otherwise, enter the tax from your 2010 Form N-11, line 26 or Form N-15,

line 43. (See Instructions) .......................................................................................

19

20. If you used Form N-168 to figure your tax for 2011, enter the amount

from your 2011 Form N-168, line 4. Otherwise, enter the tax from your

2011 Form N-11, line 27 or Form N-15, line 43. (See Instructions) .......................

20

21. Add lines 18 through 20 ..................................................................................................................................................

21

22. Tax. Line 17 minus line 21. Also include this amount in the total tax on Form N-11, line 27 or Form N-15, line 43. ...

22

Caution. Your tax may be less if you figure it using the 2012 Tax Table, Tax Rate Schedules, or Capital Gains Tax

Worksheet. Attach Form N-168 only if you are using it to figure your tax.

FORM N-168

1

1