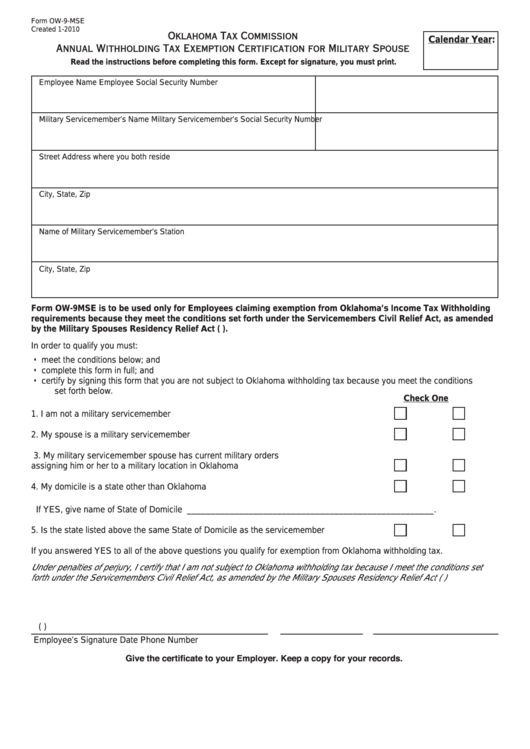

Form OW-9-MSE

Created 1-2010

Oklahoma Tax Commission

Calendar Year:

Annual Withholding Tax Exemption Certification for Military Spouse

Read the instructions before completing this form. Except for signature, you must print.

Employee Name

Employee Social Security Number

Military Servicemember’s Name

Military Servicemember’s Social Security Number

Street Address where you both reside

City, State, Zip

Name of Military Servicemember’s Station

City, State, Zip

Form OW-9MSE is to be used only for Employees claiming exemption from Oklahoma’s Income Tax Withholding

requirements because they meet the conditions set forth under the Servicemembers Civil Relief Act, as amended

by the Military Spouses Residency Relief Act (P.L. 111-97).

In order to qualify you must:

• meet the conditions below; and

• complete this form in full; and

• certify by signing this form that you are not subject to Oklahoma withholding tax because you meet the conditions

set forth below.

Check One

1. I am not a military servicemember ........................................................................... YES

NO

2. My spouse is a military servicemember ................................................................... YES

NO

3. My military servicemember spouse has current military orders

assigning him or her to a military location in Oklahoma .......................................... YES

NO

4. My domicile is a state other than Oklahoma ............................................................ YES

NO

If YES, give name of State of Domicile ____________________________________________________ .

5. Is the state listed above the same State of Domicile as the servicemember .......... YES

NO

If you answered YES to all of the above questions you qualify for exemption from Oklahoma withholding tax.

Under penalties of perjury, I certify that I am not subject to Oklahoma withholding tax because I meet the conditions set

forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act (P.L. 111-97)

(

)

Employee’s Signature

Date

Phone Number

Give the certificate to your Employer. Keep a copy for your records.

1

1 2

2