Form Fid-D Annual Withholding Of Net Income From A Fiduciary Detail Report - 2014

ADVERTISEMENT

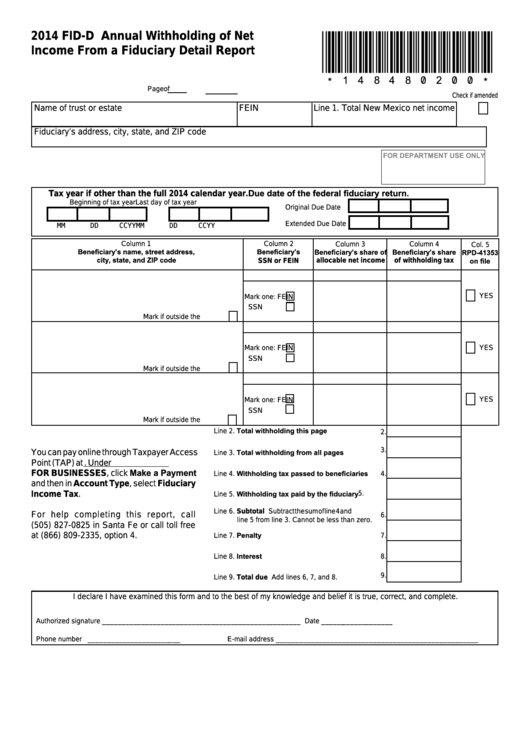

2014 FID-D Annual Withholding of Net

*148480200*

Income From a Fiduciary Detail Report

Page

of

Check if amended

Name of trust or estate

Line 1. Total New Mexico net income

FEIN

Fiduciary’s address, city, state, and ZIP code

FOR DEPARTMENT USE ONLY

Due date of the federal fiduciary return.

Tax year if other than the full 2014 calendar year.

Beginning of tax year

Last day of tax year

Original Due Date

Extended Due Date

MM

DD

CCYY

MM

DD

CCYY

Column 1

Column 2

Column 3

Column 4

Col. 5

Beneficiary’s name, street address,

Beneficiary’s

Beneficiary’s share

Beneficiary’s share of

RPD-41353

city, state, and ZIP code

on file

SSN or FEIN

allocable net income

of withholding tax

YES

Mark one:

FEIN

SSN

Mark if outside the U.S.

YES

Mark one:

FEIN

SSN

Mark if outside the U.S.

YES

Mark one:

FEIN

SSN

Mark if outside the U.S.

Line 2. Total withholding this page

2.

3.

Line 3. Total withholding from all pages

You can pay online through Taxpayer Access

Point (TAP) at https://tap.state.nm.us. Under

FOR BUSINESSES, click Make a Payment

Line 4. Withholding tax passed to beneficiaries

4.

and then in Account Type, select Fiduciary

Line 5. Withholding tax paid by the fiduciary

Income Tax.

5.

Line 6. Subtotal Subtract the sum of line 4 and

For help completing this report, call

6.

line 5 from line 3. Cannot be less than zero.

(505) 827-0825 in Santa Fe or call toll free

Line 7. Penalty

at (866) 809-2335, option 4.

7.

Line 8. Interest

8.

9.

Line 9. Total due Add lines 6, 7, and 8.

I declare I have examined this form and to the best of my knowledge and belief it is true, correct, and complete.

Authorized signature ___________________________________________________ Date ___________________

Phone number ________________________

E-mail address ____________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2