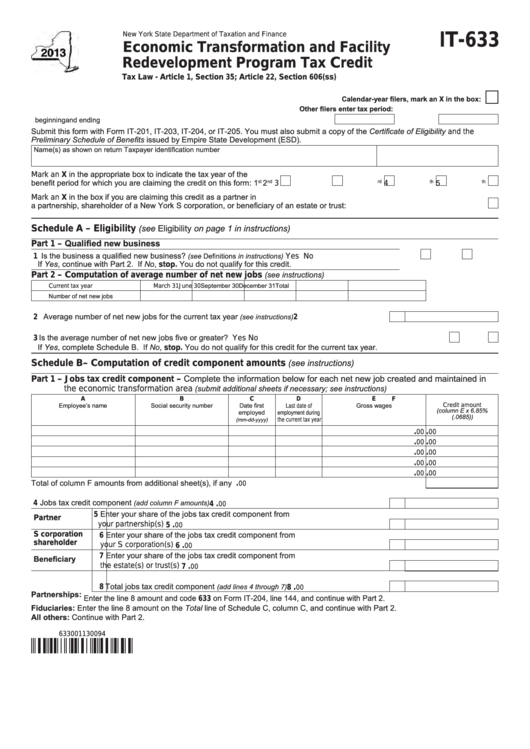

New York State Department of Taxation and Finance

IT-633

Economic Transformation and Facility

Redevelopment Program Tax Credit

Tax Law - Article 1, Section 35; Article 22, Section 606(ss)

Calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

Submit this form with Form IT-201, IT-203, IT-204, or IT-205. You must also submit a copy of the Certificate of Eligibility and the

Preliminary Schedule of Benefits issued by Empire State Development (ESD).

Name(s) as shown on return

Taxpayer identification number

Mark an X in the appropriate box to indicate the tax year of the

benefit period for which you are claiming the credit on this form:

1

2

5

st

nd

3

rd

4

th

th

Mark an X in the box if you are claiming this credit as a partner in

a partnership, shareholder of a New York S corporation, or beneficiary of an estate or trust: ................................................................

(see Eligibility on page 1 in instructions)

Schedule A – Eligibility

Part 1 – Qualified new business

1 Is the business a qualified new business?

..................................................... Yes

(see Definitions in instructions)

No

If Yes, continue with Part 2. If No, stop. You do not qualify for this credit.

(see instructions)

Part 2 – Computation of average number of net new jobs

September 30

December 31

Total

Current tax year

March 31

June 30

Number of net new jobs

2 Average number of net new jobs for the current tax year

...........................................

(see instructions)

2

3 Is the average number of net new jobs five or greater? ...........................................................................................Yes

No

If Yes, complete Schedule B. If No, stop. You do not qualify for this credit for the current tax year.

(see instructions)

Schedule B – Computation of credit component amounts

Part 1 – Jobs tax credit component – Complete the information below for each net new job created and maintained in

(submit additional sheets if necessary; see instructions)

the economic transformation area

A

B

C

D

E

F

Employee’s name

Social security number

Date first

Gross wages

Credit amount

Last date of

(column E x 6.85%

employed

employment during

(.0685))

(mm-dd-yyyy)

the current tax year

.

.

00

00

.

.

00

00

.

.

00

00

.

.

00

00

.

.

00

00

Total of column F amounts from additional sheet(s), if any .........................................................................................

.

00

4 Jobs tax credit component

...............................................................................

(add column F amounts)

.

4

00

5 Enter your share of the jobs tax credit component from

Partner

your partnership(s) ............................................................................................

.

5

00

6 Enter your share of the jobs tax credit component from

S corporation

shareholder

your S corporation(s) .........................................................................................

.

6

00

7 Enter your share of the jobs tax credit component from

Beneficiary

the estate(s) or trust(s) ......................................................................................

.

7

00

8 Total jobs tax credit component

............................................

(add lines 4 through 7)

.

8

00

Partnerships: Enter the line 8 amount and code 633 on Form IT-204, line 144, and continue with Part 2.

Fiduciaries: Enter the line 8 amount on the Total line of Schedule C, column C, and continue with Part 2.

All others: Continue with Part 2.

633001130094

1

1 2

2 3

3 4

4