Form Ct-1120dl - Donation Of Land Tax Credits - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-1120DL

State of Connecticut

(Rev. 01/13)

Donation of Land Tax Credits

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Definitions

Complete this form in blue or black ink only.

Use Form CT-1120DL to claim the credit allowed under Conn.

Donation of open space land means the value of any land

conveyed without financial consideration, or the value of any

Gen. Stat. §12-217dd for the donation of open space land,

and the credit allowed under Conn. Gen. Stat. §12-217ff for

discount of the sale price in any sale of land or any interest

the donation of land for educational use. Attach this form to

in land, to the state, a political subdivision of the state, or a

nonprofit land conservation organization, where the land is to

Form CT-1120K, Business Tax Credit Summary.

be permanently preserved as protected open space or used

Credit Computation

as a public water supply source.

A tax credit is allowed against the tax imposed under

Donation of land for educational use means the value

of any land or interest in land conveyed without financial

Conn. Gen. Stat. §12-217 in an amount equal to 50% of

any donation of open space land. In order to qualify for the

consideration, or the value of any discount of the sale price

credit, the donated land must be permanently preserved

in any sale of land or interest in land, to any town, city, or

as protected open space or used as a public water supply

borough, whether consolidated or unconsolidated, and any

source.

school district or regional school district for the purposes of

schools and related facilities.

A tax credit is also allowed against the tax imposed under

Conn. Gen. Stat. §12-217 in an amount equal to 50% of any

Use value means the fair market value of land at its highest

donation of land for educational use.

and best use, as determined by a certified real estate

appraiser.

For purposes of calculating the credit, the amount of donation

shall be based on the difference between use value of the

Additional Information

donated land and the amount received for the land.

See Informational Publication 2010(13), Guide to

Carryforward/Carryback

Connecticut Business Tax Credits, or contact the Department

of Revenue Services, Taxpayer Services Division at

Any remaining donation of open space land tax credit balance

1-800-382-9463 (Connecticut calls outside the Greater

that exceeds the tax credit applied may be carried forward

Hartford calling area only) or 860-297-5962 (from

for 25 succeeding income years.

anywhere).

Any remaining donation of land for educational use tax credit

balance that exceeds the tax credit applied may be carried

forward for 15 succeeding income years.

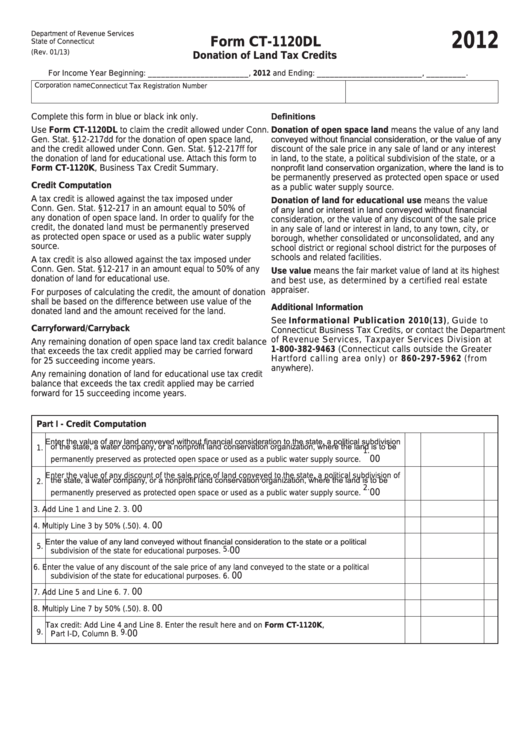

Part I - Credit Computation

Enter the value of any land conveyed without financial consideration to the state, a political subdivision

1.

of the state, a water company, or a nonprofit land conservation organization, where the land is to be

1.

00

permanently preserved as protected open space or used as a public water supply source.

Enter the value of any discount of the sale price of land conveyed to the state, a political subdivision of

2.

the state, a water company, or a nonprofit land conservation organization, where the land is to be

2.

00

permanently preserved as protected open space or used as a public water supply source.

00

3. Add Line 1 and Line 2.

3.

00

4. Multiply Line 3 by 50% (.50).

4.

Enter the value of any land conveyed without financial consideration to the state or a political

5.

5.

00

subdivision of the state for educational purposes.

6. Enter the value of any discount of the sale price of any land conveyed to the state or a political

00

subdivision of the state for educational purposes.

6.

00

7. Add Line 5 and Line 6.

7.

00

8. Multiply Line 7 by 50% (.50).

8.

Tax credit: Add Line 4 and Line 8. Enter the result here and on Form CT-1120K,

9.

9.

00

Part I-D, Column B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2