Form Ct-1120dl - Donation Of Land Tax Credits - 2012 Page 2

ADVERTISEMENT

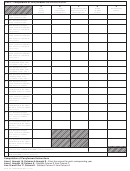

Part II - Computation of Carryforward

See instructions below.

A

B

C

D

E

Total

Credit

Carryforward to 2012

Credit

Carryforward

Credit

Applied 2000

Subtract Column B

Applied

to 2013

Earned

Through 2011

from Column A.

to 2012

1. 2000 Donation of Open

Space Land tax credit

2. 2001 Donation of Open

Space Land tax credit

3. 2002 Donation of Open

Space Land tax credit from

2002 Form CT-1120 DOS,

Part I, Line 5.

4. 2003 Donation of Open

Space Land tax credit from

2003 Form CT-1120 DOS,

Part I, Line 5.

5. 2004 Donation of Open

Space Land tax credit from

2004 Form CT-1120 DOS,

Part I, Line 5

6. 2005 Donation of Open

Space Land tax credit from

2005 Form CT-1120 DOS,

Part I, Line 5

7. 2006 Donation of Land

tax credit from 2006 Form

CT-1120DL, Part I, Line 7

8. 2007 Donation of Land

tax credit from 2007 Form

CT-1120DL, Part I, Line 7

9. 2008 Donation of Land tax

credit from 2008 Form

CT-1120DL, Part I, Line 7

10. 2009 Donation of Open

Space Land tax credit from

2009 Form CT-1120DL

11. 2009 Donation of Land For

Educational Use tax credit

from 2009 Form CT-1120DL

12. 2010 Donation of Open

Space Land tax credit from

2010 Form CT-1120DL,

Part 1 Line 4

13. 2010 Donation of Land For

Educational Use tax credit

from 2010 Form CT-1120DL,

Part I, Line 8

14. 2011 Donation of Open

Space Land tax credit from

2011 Form CT-1120DL,

Part 1 Line 4

15. 2011 Donation of Land For

Educational Use tax credit

from 2011 Form CT-1120DL,

Part I, Line 8

16. 2012 Donation of Open

Space Land tax credit from

2012 Form CT-1120DL,

Part 1 Line 4

17. 2012 Donation of Land For

Educational Use tax credit

from 2012 Form CT-1120DL,

Part I, Line 8

18. Total Donation of Land tax credit applied to 2012 Add Lines 1 through 17, Column D.

Enter here and on Form CT-1120K, Part I-D, Column C.

19. Total Donation of Land tax credit carryforward to 2013: Add Lines 1 through 17, Column E. Enter here and on

Form CT-1120K, Part I-D, Column E.

Computation of Carryforward Instructions

Lines 1 through 15, Columns A through D - Enter the amount for each corresponding year.

Lines 1 through 15, Column E - Subtract Column D from Column C.

Line 16 and Line 17, Column E - Subtract Column D from Column A.

Form CT-1120DL Back (Rev. 01/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2