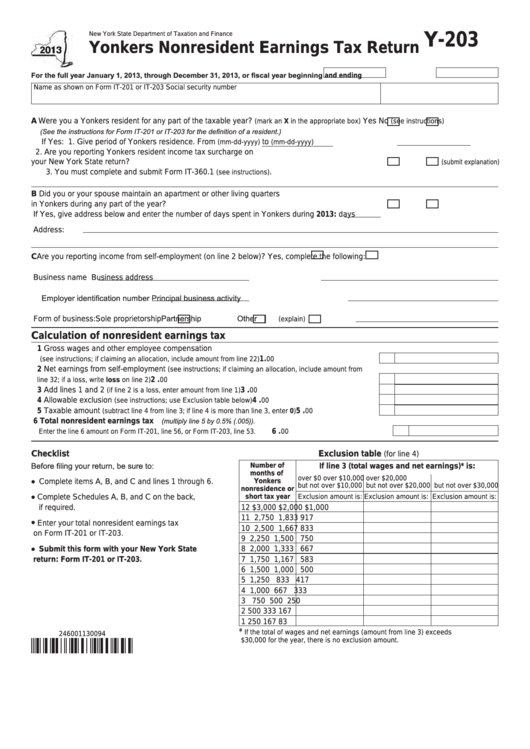

New York State Department of Taxation and Finance

Y-203

Yonkers Nonresident Earnings Tax Return

For the full year January 1, 2013, through December 31, 2013, or fiscal year beginning

and ending

Name as shown on Form IT-201 or IT-203

Social security number

A Were you a Yonkers resident for any part of the taxable year?

Yes

No

(mark an X in the appropriate box)

(see instructions)

(See the instructions for Form IT-201 or IT-203 for the definition of a resident.)

If Yes: 1. Give period of Yonkers residence. From

to

(mm-dd-yyyy)

(mm-dd-yyyy)

2. Are you reporting Yonkers resident income tax surcharge on

your New York State return? ..................................................................................... Yes

No

(submit explanation)

3. You must complete and submit Form IT-360.1

.

(see instructions)

B Did you or your spouse maintain an apartment or other living quarters

in Yonkers during any part of the year?...................................................................................... Yes

No

If Yes, give address below and enter the number of days spent in Yonkers during 2013:

days

Address:

C Are you reporting income from self-employment (on line 2 below)?......... Yes

No

If Yes, complete the following:

Business name

Business address

Employer identification number

Principal business activity

Form of business: Sole proprietorship

Partnership

Other

(explain)

Calculation of nonresident earnings tax

1 Gross wages and other employee compensation

...............................................

00

.

1

(see instructions; if claiming an allocation, include amount from line 22)

2 Net earnings from self-employment

(see instructions; if claiming an allocation, include amount from

................................................................................................

00

.

2

line 32; if a loss, write loss on line 2)

3 Add lines 1 and 2

.............................................................

00

.

3

(if line 2 is a loss, enter amount from line 1)

4 Allowable exclusion

........................................................

(see instructions; use Exclusion table below)

00

.

4

5 Taxable amount

....................................

00

.

5

(subtract line 4 from line 3; if line 4 is more than line 3, enter 0)

(multiply line 5 by 0.5% (.005)).

6 Total nonresident earnings tax

.......................................................

Enter the line 6 amount on Form IT-201, line 56, or Form IT-203, line 53.

00

.

6

Checklist

Exclusion table

(for line 4)

Before filing your return, be sure to:

Number of

If line 3 (total wages and net earnings)* is:

months of

over $0

over $10,000

over $20,000

•

Complete items A, B, and C and lines 1 through 6.

Yonkers

but not over $10,000 but not over $20,000 but not over $30,000

nonresidence or

•

Complete Schedules A, B, and C on the back,

Exclusion amount is: Exclusion amount is: Exclusion amount is:

short tax year

if required.

12

$3,000

$2,000

$1,000

11

2,750

1,833

917

•

Enter your total nonresident earnings tax

10

2,500

1,667

833

on Form IT-201 or IT-203.

9

2,250

1,500

750

•

8

2,000

1,333

667

Submit this form with your New York State

7

1,750

1,167

583

return: Form IT-201 or IT-203.

6

1,500

1,000

500

5

1,250

833

417

4

1,000

667

333

3

750

500

250

2

500

333

167

1

250

167

83

*

If the total of wages and net earnings (amount from line 3) exceeds

246001130094

$30,000 for the year, there is no exclusion amount.

1

1 2

2