Form 24734 - Application For Property Tax Incentives For New Or Expanding Businesses

ADVERTISEMENT

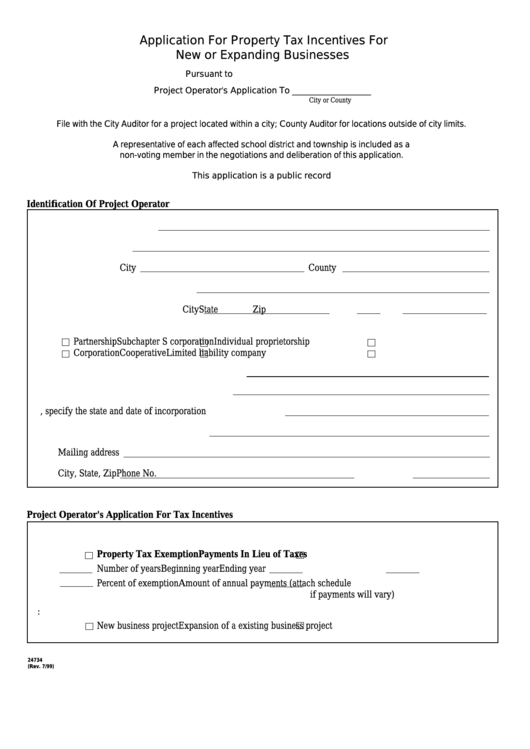

Application For Property Tax Incentives For

New or Expanding Businesses

Pursuant to N.D.C.C. Chapter 40-57.1

Project Operator's Application To __________________

City or County

File with the City Auditor for a project located within a city; County Auditor for locations outside of city limits.

A representative of each affected school district and township is included as a

non-voting member in the negotiations and deliberation of this application.

This application is a public record

Identification Of Project Operator

1.

Name of project operator

2.

Address of project

City

County

3.

Mailing address of project operator

City

State

Zip

4.

Type of ownership of project

Partnership

Subchapter S corporation

Individual proprietorship

Corporation

Cooperative

Limited liability company

5.

Federal Identification No. or Social Security No.

6.

North Dakota Sales and Use Tax Permit No.

7.

If a corporation, specify the state and date of incorporation

8.

Name and title of individual to contact

Mailing address

City, State, Zip

Phone No.

Project Operator's Application For Tax Incentives

9.

Indicate the tax incentives applied for and terms. Be specific.

Property Tax Exemption

Payments In Lieu of Taxes

Number of years

Beginning year

Ending year

Percent of exemption

Amount of annual payments (attach schedule

if payments will vary)

10. Which of the following would better describe the project for which this application is being made:

New business project

Expansion of a existing business project

24734

(Rev. 7/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5