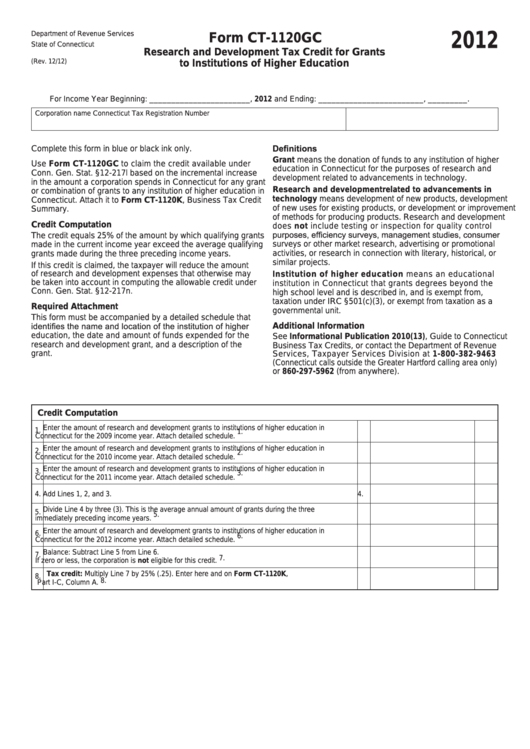

Form Ct-1120gc - Research And Development Tax Credit For Grants To Institutions Of Higher Education - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-1120GC

State of Connecticut

Research and Development Tax Credit for Grants

(Rev. 12/12)

to Institutions of Higher Education

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Definitions

Complete this form in blue or black ink only.

Grant means the donation of funds to any institution of higher

Use Form CT-1120GC to claim the credit available under

education in Connecticut for the purposes of research and

Conn. Gen. Stat. §12-217l based on the incremental increase

development related to advancements in technology.

in the amount a corporation spends in Connecticut for any grant

Research and development related to advancements in

or combination of grants to any institution of higher education in

technology means development of new products, development

Connecticut. Attach it to Form CT-1120K, Business Tax Credit

of new uses for existing products, or development or improvement

Summary.

of methods for producing products. Research and development

Credit Computation

does not include testing or inspection for quality control

purposes, efficiency surveys, management studies, consumer

The credit equals 25% of the amount by which qualifying grants

surveys or other market research, advertising or promotional

made in the current income year exceed the average qualifying

activities, or research in connection with literary, historical, or

grants made during the three preceding income years.

similar projects.

If this credit is claimed, the taxpayer will reduce the amount

of research and development expenses that otherwise may

Institution of higher education means an educational

be taken into account in computing the allowable credit under

institution in Connecticut that grants degrees beyond the

Conn. Gen. Stat. §12-217n.

high school level and is described in, and is exempt from,

taxation under IRC §501(c)(3), or exempt from taxation as a

Required Attachment

governmental unit.

This form must be accompanied by a detailed schedule that

identifies the name and location of the institution of higher

Additional Information

education, the date and amount of funds expended for the

See Informational Publication 2010(13), Guide to Connecticut

research and development grant, and a description of the

Business Tax Credits, or contact the Department of Revenue

grant.

Services, Taxpayer Services Division at 1-800-382-9463

(Connecticut calls outside the Greater Hartford calling area only)

or 860-297-5962 (from anywhere).

Credit Computation

1. Enter the amount of research and development grants to institutions of higher education in

1.

Connecticut for the 2009 income year. Attach detailed schedule.

2. Enter the amount of research and development grants to institutions of higher education in

2.

Connecticut for the 2010 income year. Attach detailed schedule.

3. Enter the amount of research and development grants to institutions of higher education in

3.

Connecticut for the 2011 income year. Attach detailed schedule.

4. Add Lines 1, 2, and 3.

4.

5. Divide Line 4 by three (3). This is the average annual amount of grants during the three

5.

immediately preceding income years.

6. Enter the amount of research and development grants to institutions of higher education in

6.

Connecticut for the 2012 income year. Attach detailed schedule.

7. Balance: Subtract Line 5 from Line 6.

7.

If zero or less, the corporation is not eligible for this credit.

8. Tax credit: Multiply Line 7 by 25% (.25). Enter here and on Form CT-1120K,

8.

Part I-C, Column A.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1