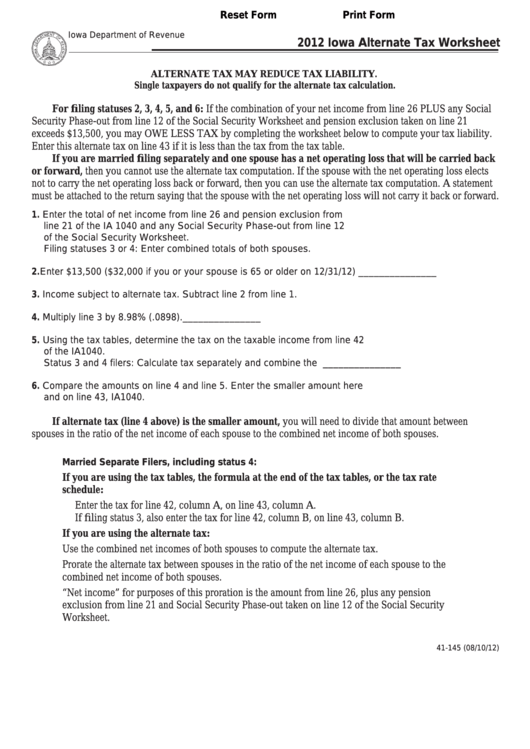

Reset Form

Print Form

Iowa Department of Revenue

2012 Iowa Alternate Tax Worksheet

ALTERNATE TAX MAY REDUCE TAX LIABILITY.

Single taxpayers do not qualify for the alternate tax calculation.

For filing statuses 2, 3, 4, 5, and 6: If the combination of your net income from line 26 PLUS any Social

Security Phase-out from line 12 of the Social Security Worksheet and pension exclusion taken on line 21

exceeds $13,500, you may OWE LESS TAX by completing the worksheet below to compute your tax liability.

Enter this alternate tax on line 43 if it is less than the tax from the tax table.

If you are married filing separately and one spouse has a net operating loss that will be carried back

or forward, then you cannot use the alternate tax computation. If the spouse with the net operating loss elects

not to carry the net operating loss back or forward, then you can use the alternate tax computation. A statement

must be attached to the return saying that the spouse with the net operating loss will not carry it back or forward.

1. Enter the total of net income from line 26 and pension exclusion from

line 21 of the IA 1040 and any Social Security Phase-out from line 12

of the Social Security Worksheet.

Filing statuses 3 or 4: Enter combined totals of both spouses. ...................... 1. _______________

2. Enter $13,500 ($32,000 if you or your spouse is 65 or older on 12/31/12). ... 2. _______________

3. Income subject to alternate tax. Subtract line 2 from line 1. ........................... 3. _______________

4. Multiply line 3 by 8.98% (.0898). ....................................................................... 4. _______________

5. Using the tax tables, determine the tax on the taxable income from line 42

of the IA1040.

Status 3 and 4 filers: Calculate tax separately and combine the amounts. ... 5. _______________

6. Compare the amounts on line 4 and line 5. Enter the smaller amount here

and on line 43, IA1040. ..................................................................................... 6. _______________

If alternate tax (line 4 above) is the smaller amount, you will need to divide that amount between

spouses in the ratio of the net income of each spouse to the combined net income of both spouses.

Married Separate Filers, including status 4:

If you are using the tax tables, the formula at the end of the tax tables, or the tax rate

schedule:

Enter the tax for line 42, column A, on line 43, column A.

If filing status 3, also enter the tax for line 42, column B, on line 43, column B.

If you are using the alternate tax:

Use the combined net incomes of both spouses to compute the alternate tax.

Prorate the alternate tax between spouses in the ratio of the net income of each spouse to the

combined net income of both spouses.

“Net income” for purposes of this proration is the amount from line 26, plus any pension

exclusion from line 21 and Social Security Phase-out taken on line 12 of the Social Security

Worksheet.

41-145 (08/10/12)

1

1