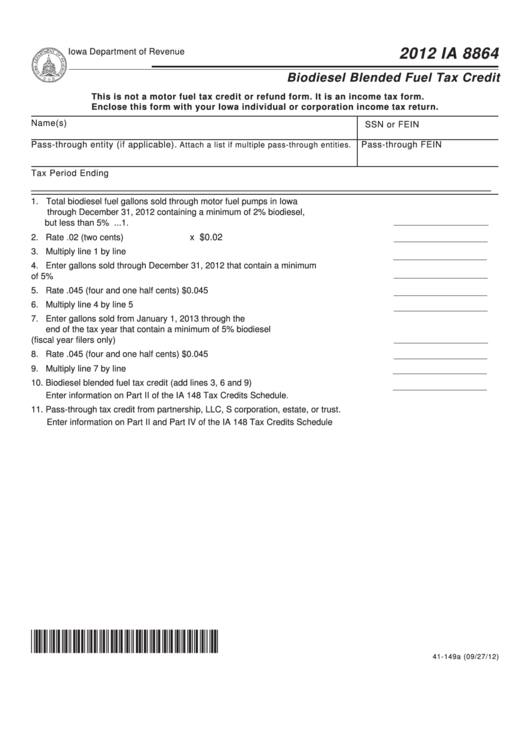

2012 IA 8864

Iowa Department of Revenue

Biodiesel Blended Fuel Tax Credit

This is not a motor fuel tax credit or refund form. It is an income tax form.

Enclose this form with your Iowa individual or corporation income tax return.

Name(s)

SSN or FEIN

Pass-through entity (if applicable).

Pass-through FEIN

Attach a list if multiple pass-through entities.

Tax Period Ending

_________________________________________________________________________________________________

1. Total biodiesel fuel gallons sold through motor fuel pumps in Iowa

through December 31, 2012 containing a minimum of 2% biodiesel,

..................................................................... ...1.

but less than 5% biodiesel....................

x $0.02

2. Rate .02 (two cents).........................................................................................................2.

3. Multiply line 1 by line 2.....................................................................................................3.

4. Enter gallons sold through December 31, 2012 that contain a minimum

of 5% biodiesel.................................................................................................................4.

5. Rate .045 (four and one half cents)..................................................................................5.

x $0.045

6. Multiply line 4 by line 5 ....................................................................................................6.

7. Enter gallons sold from January 1, 2013 through the

end of the tax year that contain a minimum of 5% biodiesel

(fiscal year filers only)......................................................................................................7.

8. Rate .045 (four and one half cents)..................................................................................8.

x $0.045

9. Multiply line 7 by line 8.....................................................................................................9.

10. Biodiesel blended fuel tax credit (add lines 3, 6 and 9)..................................................10.

Enter information on Part II of the IA 148 Tax Credits Schedule.

11. Pass-through tax credit from partnership, LLC, S corporation, estate, or trust.

Enter information on Part II and Part IV of the IA 148 Tax Credits Schedule .................11. ___________________

*1241149019999*

41-149a (09/27/12)

1

1 2

2